What it means: COVID-19 Deferral of Employee FICA Tax

Descrição

On August 8, 2020, President Trump signed an Executive Order Deferring Employee FICA Taxes. We’ve put together a guide clarifying what the order means and who it applies to.

CARES Act Social Security Tax Deferral and Credit for Employers

Maximum Deferral of Self-Employment Tax Payments

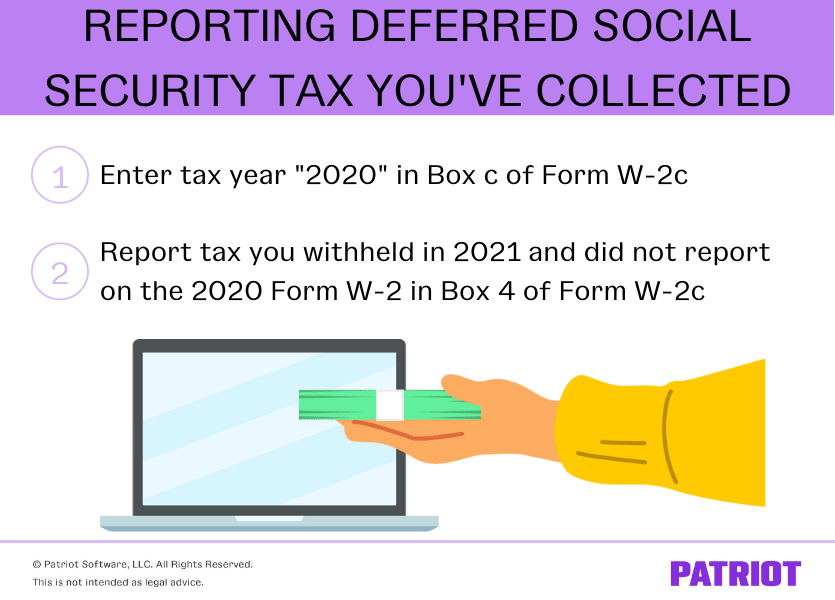

Reporting COVID Pay on W-2 2021

Information on Social Security (OASDI) tax deferment > Joint Base San Antonio > News

Customer Support during COVID-19

COVID-19 Business Tax Relief - Taxpayer Advocate Service

Executive Order to Defer Social Security Taxes Unlikely to Affect Program Sustainability—But Social Security Reform Desperately Required, Payroll Tax Cut Possible

IRS Fails on Guidance on Employee Payroll Tax Deferral

Self-employed Social Security Tax Deferral

IRS Issues Guidance for Executive Order on Payroll Tax Deferral - Sikich LLP

Pros & Cons of President Trump's Payroll Tax Deferral

Pay It Now or Pay It Later…What You Need to Know about Deferral of Employee Social Security Tax - PYA

IRS Issues Guidance on COVID-19 Deferral of Social Security Tax

What You Need to Know About the Payroll Tax Deferral

de

por adulto (o preço varia de acordo com o tamanho do grupo)