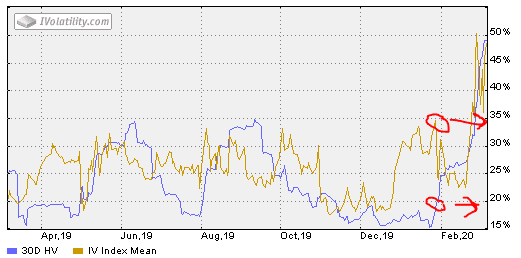

How derivative traders can make the most of increased volatility

Descrição

It has become routine for Nifty to go up or down by 300 points —around 1,000 points on the Sensex—daily. Though heightened volatility unnerves normal investors, it spells opportunities for derivative traders.

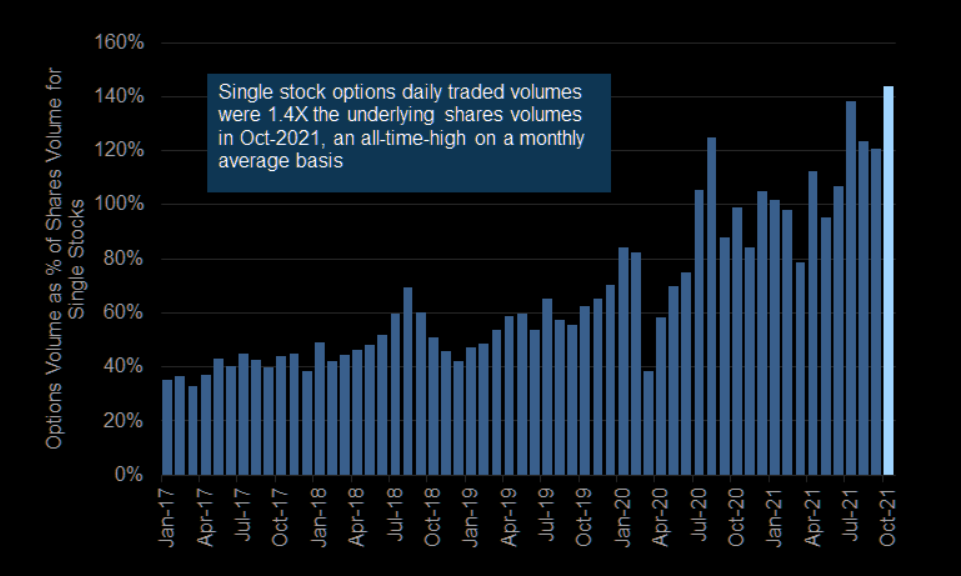

Big traders flock to US equity options with fleeting lifespans

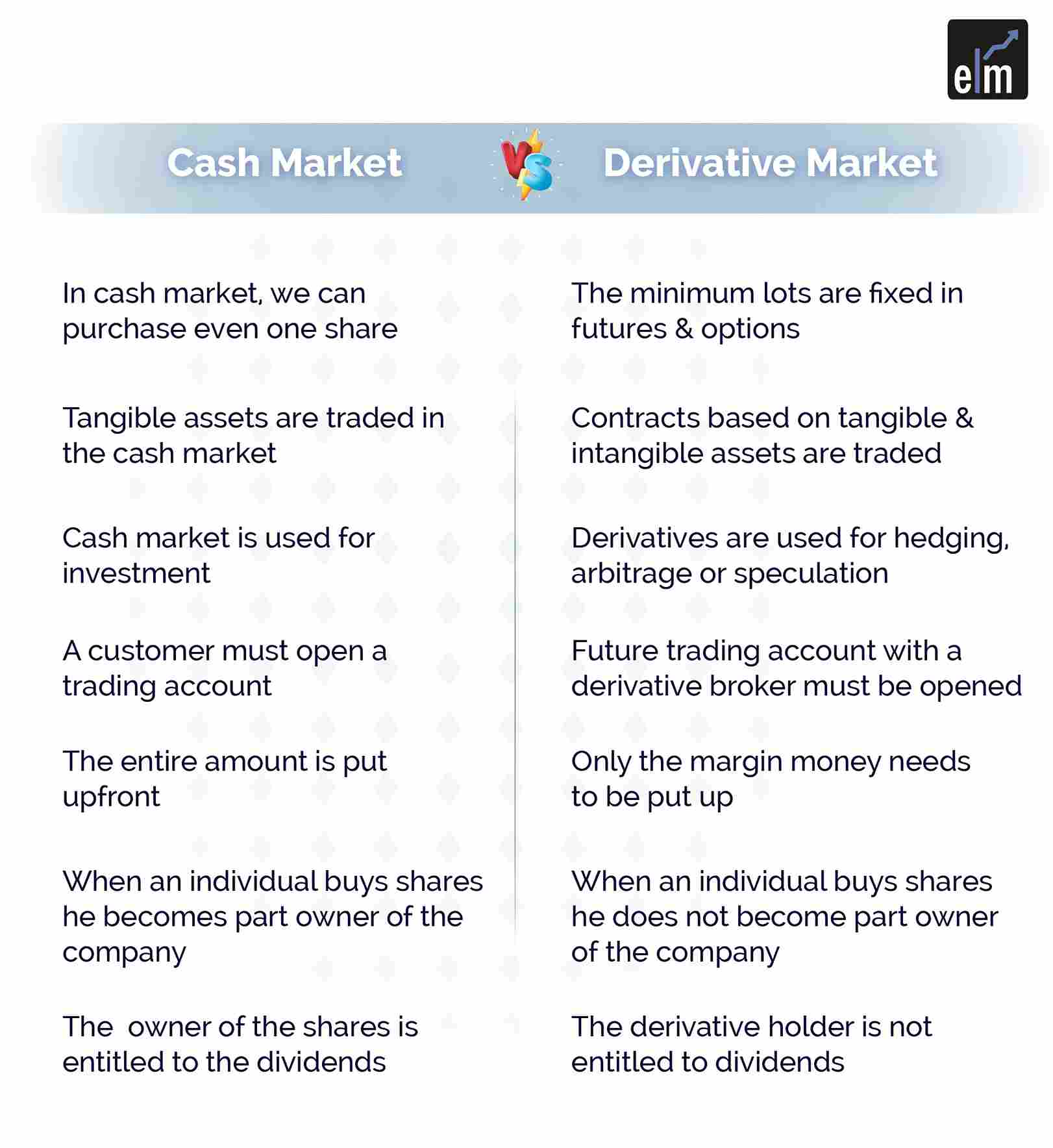

What are Derivatives and How do You Trade Derivative Markets?

The risks from derivatives have morphed

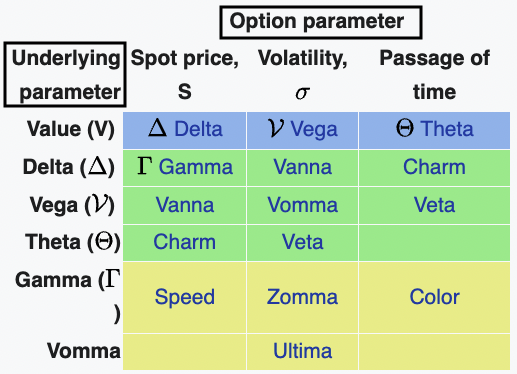

Vega Explained: Understanding Options Trading Greeks

Market Volatility: Why Is Crypto So Volatile?

Volatility Trading Strategies – Profit W/o Forecasting Direction

Derivatives Market-Understanding The Powerful Derivatives Trading-2023

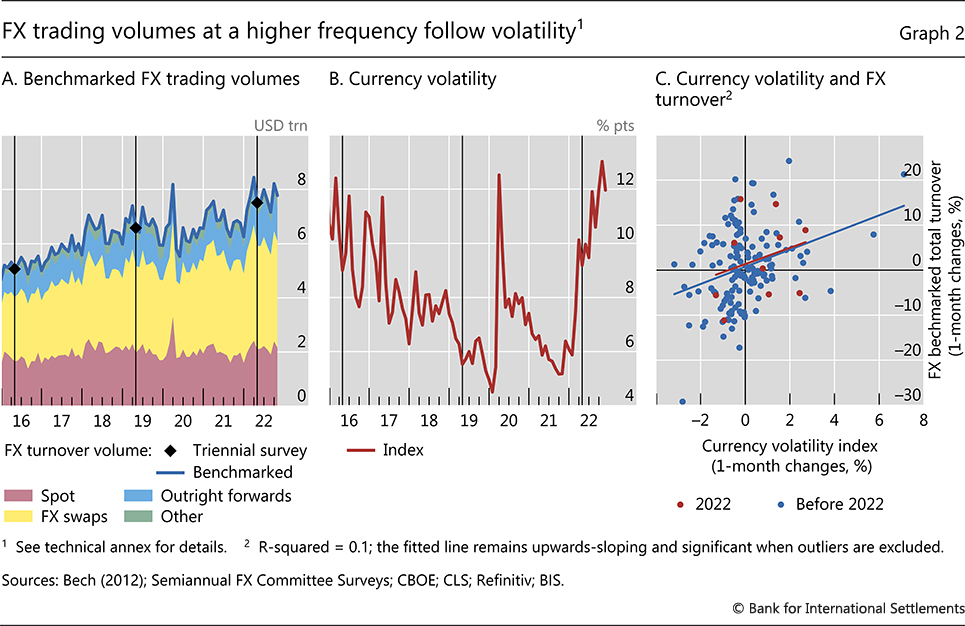

The global foreign exchange market in a higher-volatility environment

What is Volatility & How it can Affects You in 2023?

Gamma & Gamma Exposure - What Traders Need to Know — Opinicus Holdings

:max_bytes(150000):strip_icc()/Volatility-89fb205b705c493ba02c00a3fc4964cd.jpg)

Volatility: Meaning In Finance and How it Works with Stocks

Gross exposure in trading: Strategies for Managing Volatility

19+ Greeks to Know for Options Pricing [First-, Second-, and Third

de

por adulto (o preço varia de acordo com o tamanho do grupo)