The advisory has directed taxpayers to check bank validation for

Descrição

Jun 22, 2023 - The advisory has directed taxpayers to check bank validation for their GSTINs on the portal. The GSTN released the advisory on 24th April 2023, advising taxpayers to cross-check the bank account validation in GST. The taxpayer must take suitable action or wait, depending on the bank account validation status. Following are the types of bank account validation status- Success Failure Success with remark Pending for verification

:max_bytes(150000):strip_icc()/form-1099-int.asp-final-2599de13e6834f20ae53280607b01e17.jpg)

Form 1099-INT: What It Is, Who Files It, and Who Receives It

5.19.1 Balance Due Internal Revenue Service

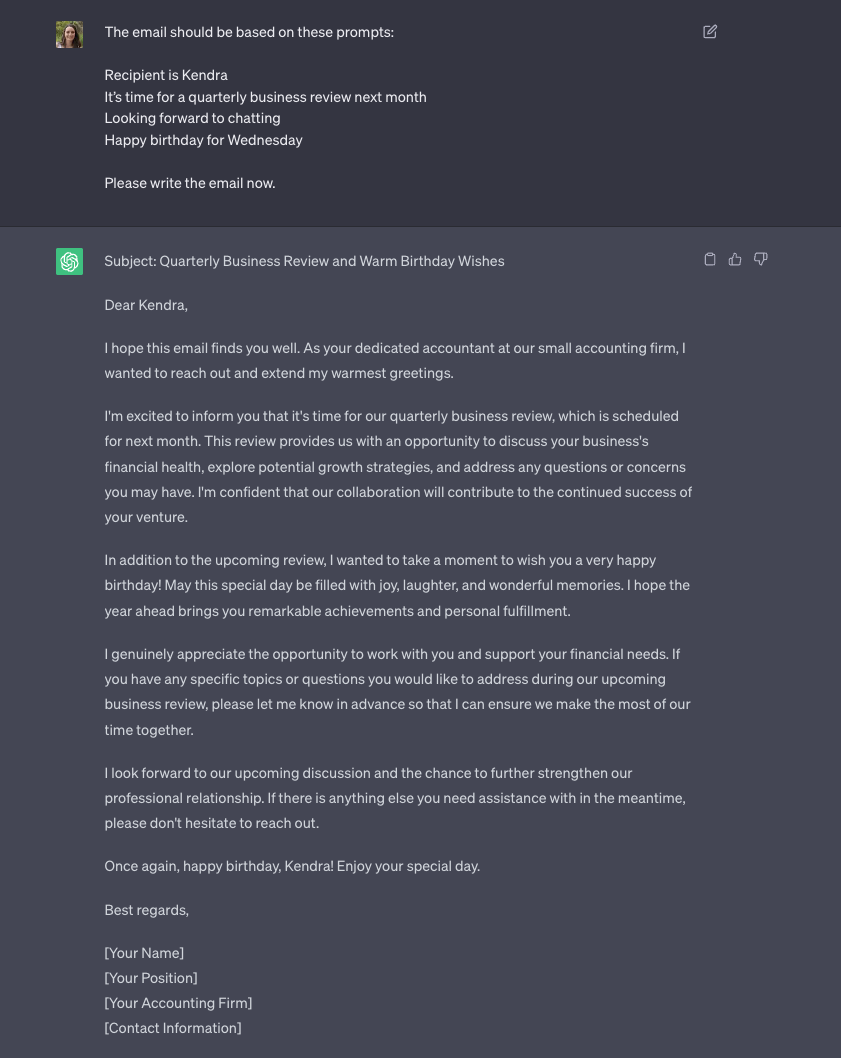

A Banking App Has Been Suddenly Closing Accounts, Sometimes Not Returning Customers' Money — ProPublica

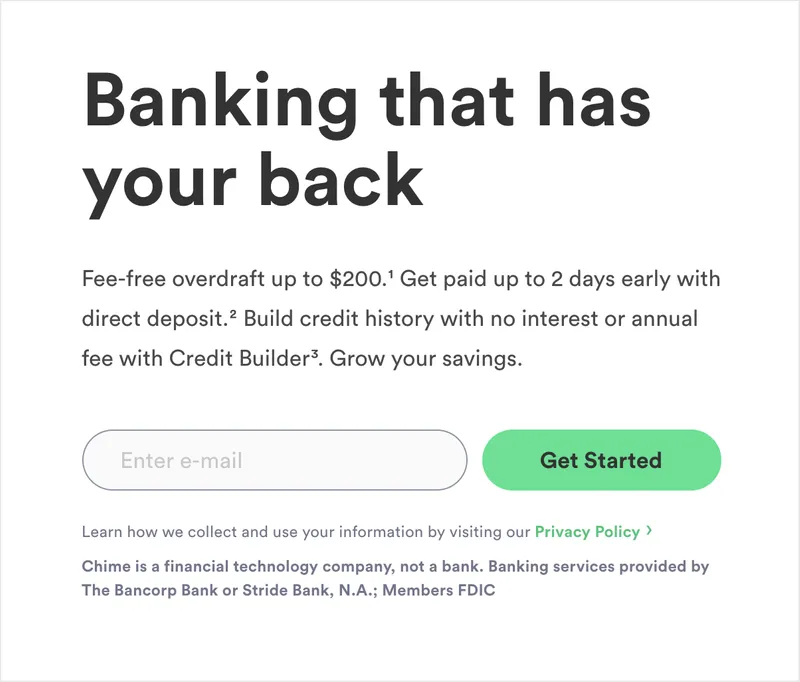

Congress Proposes Rules That Will Impact IRA Plans

:max_bytes(150000):strip_icc()/1099-A-0151e1f82f624920b802b26d693d47f6.jpg)

Form 1099-A: Acquisition or Abandonment of Secured Property

Gold IRAs—Guidelines You Should Know

Phishing - Wikipedia

2023 YE Tax Planning: Charitable Contributions

Large bank strength during the COVID financial shock: Not all it was purported to be

Taxes 2022: 7 On Your Side, United Way answer viewer questions during Tax Chat - ABC7 San Francisco

de

por adulto (o preço varia de acordo com o tamanho do grupo)