What Is FICA Tax, Understanding Payroll Tax Requirements

Descrição

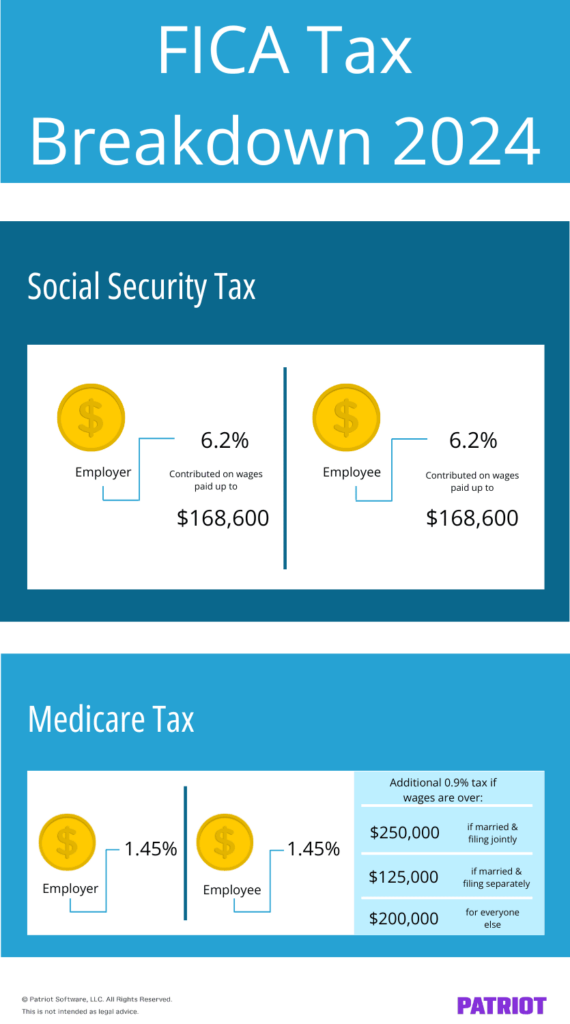

FICA tax refers to the taxes withheld by employers for Social Security and Medicare. Learn more about the FICA tax and how it’s calculated.

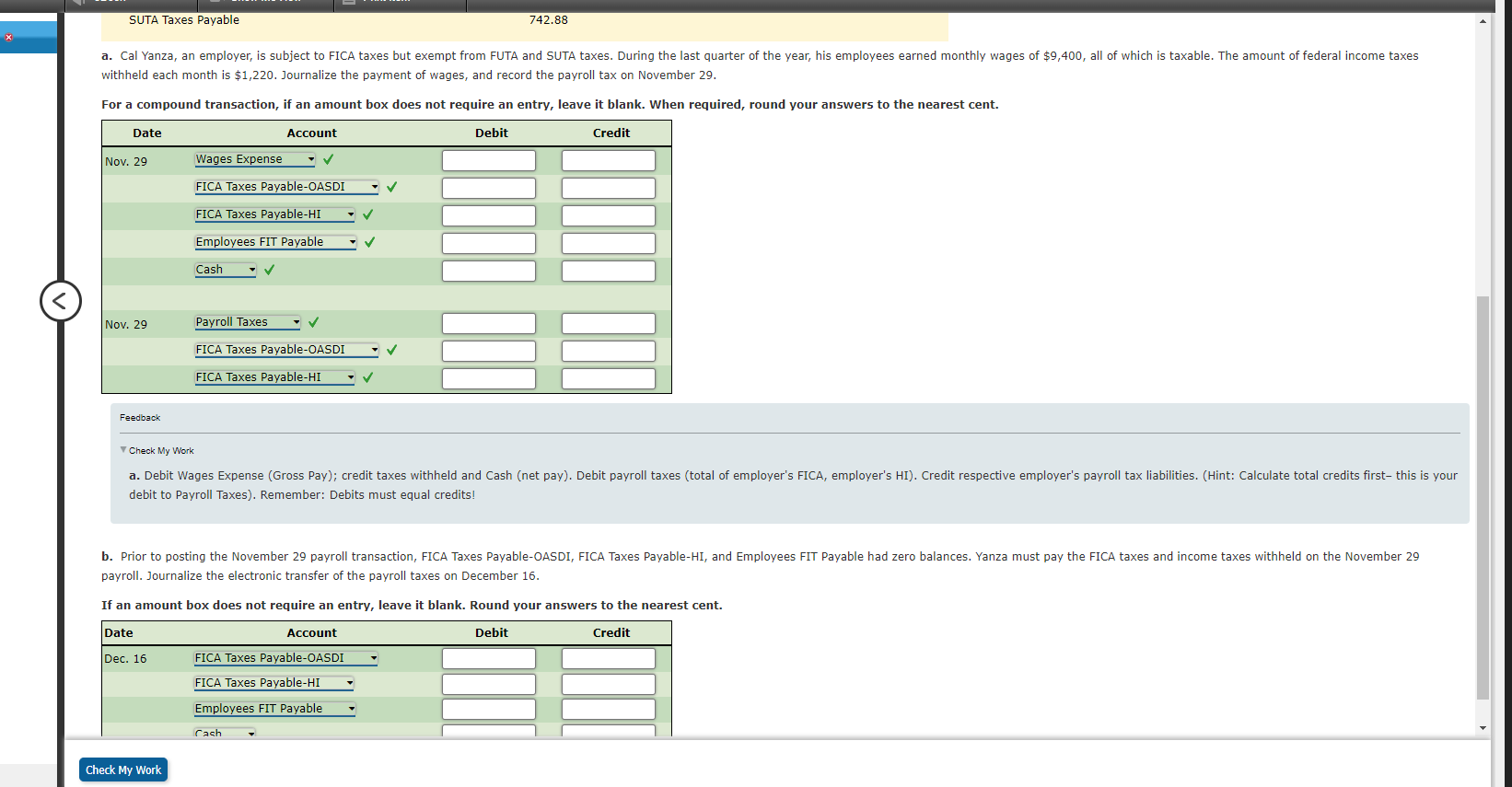

Solved a. Cal Yanza, an employer, is subject to FICA taxes

FICA Tax: What is FICA Tax, Rates, Exemptions and Calculations

fica tax - FasterCapital

According to the accountant of Ulster Inc., its payroll taxes for the week were as follows: $138.50 for FICA taxes, $18.50 for federal unemployment taxes, and $89.50 for state unemployment taxes. Jo

Distributional Effects of Raising the Social Security Payroll Tax

Understanding FICA (Social Security and Medicare) Taxes - MyIRSteam

How Are Payroll Taxes Different From Personal Income Taxes?

Payroll Tax Calculator for Employers

Employer Payroll Taxes: What You Need to Know - FasterCapital

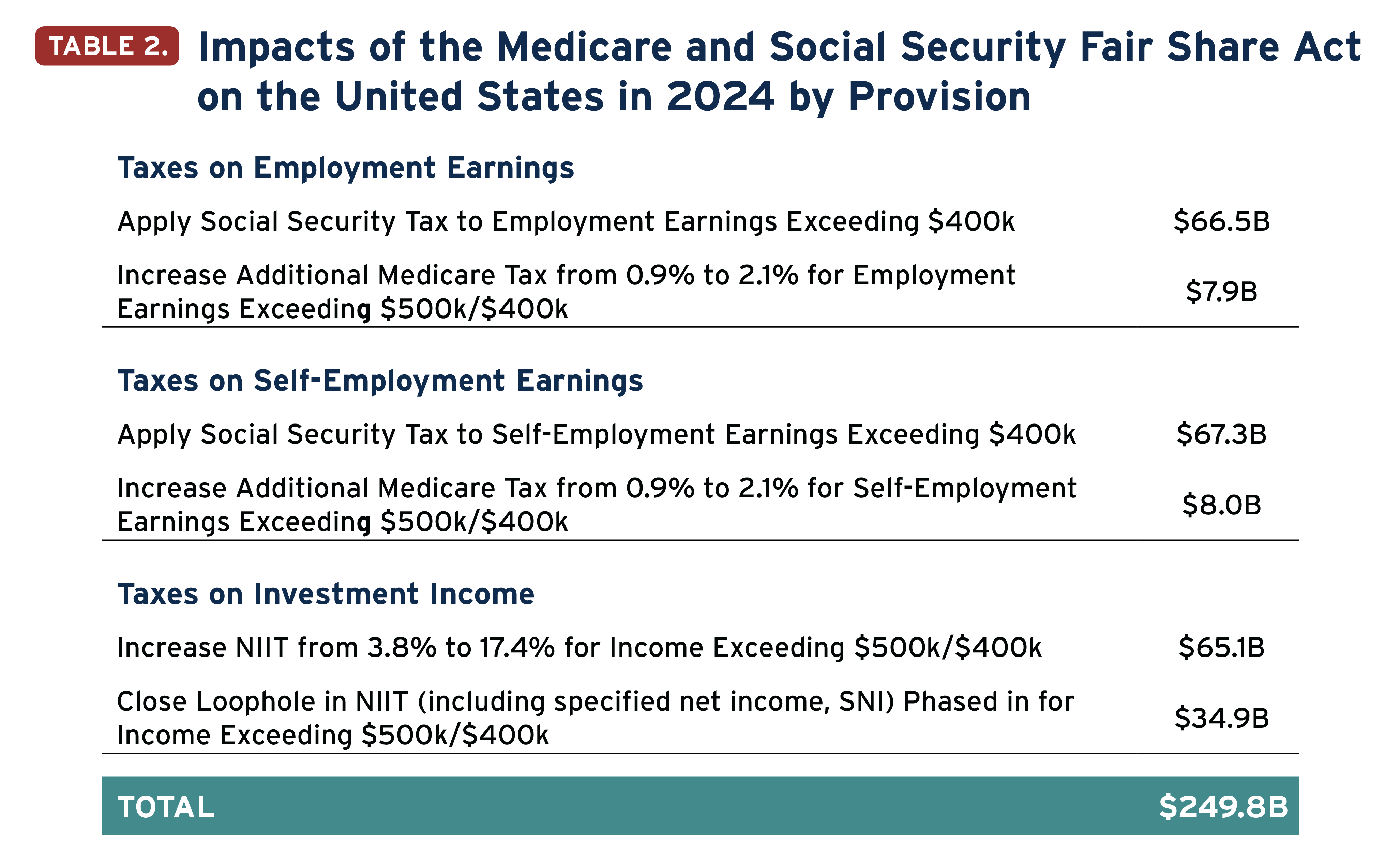

Fair Share Act' Would Strengthen Medicare and Social Security Taxes – ITEP

Which taxes are only paid by the employer? - Quora

Unraveling Payroll Tax Responsibility: Who Pays and Why

de

por adulto (o preço varia de acordo com o tamanho do grupo)