Useful Life Definition and Use in Depreciation of Assets

Descrição

The useful life of an asset is an estimate of the number of years it is likely to remain in service for the purpose of cost-effective revenue generation.

Depreciation for Nonprofits: An often neglected, but essential noncash expense for nonprofit organizations - Community Vision

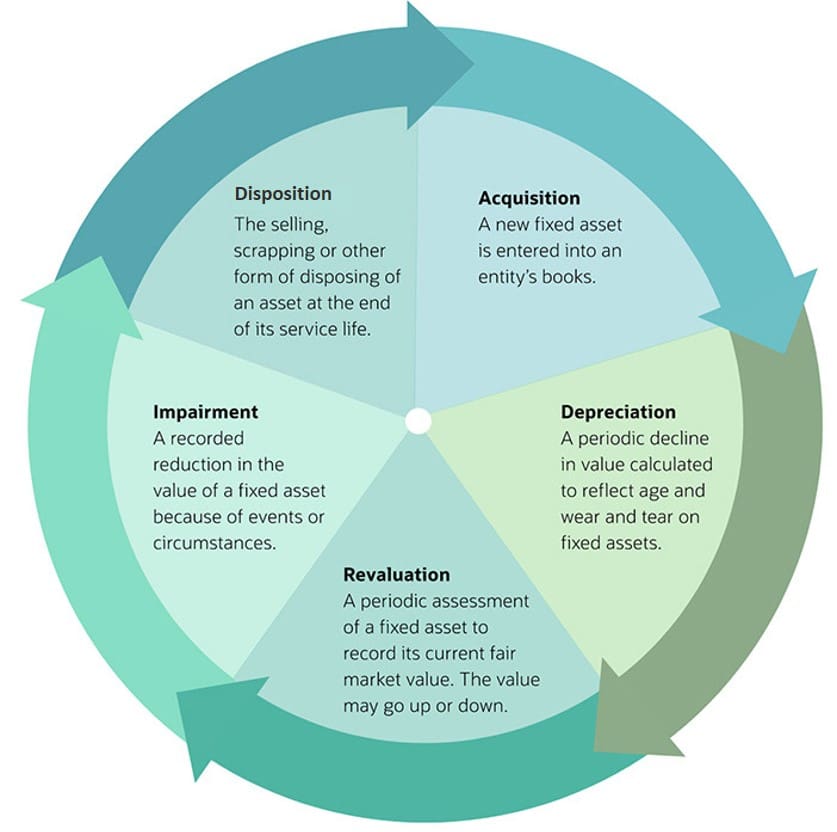

Fixed-Asset Accounting Basics

Useful Life - Definition, Formula, Example

What is the 75% economic life threshold in determining whether is a lease is finance or operating? - Universal CPA Review

:max_bytes(150000):strip_icc()/Economic-Life-Final-cf7a1c9355b341cdb07c4766fb63057d.jpg)

Economic Life: Definition, Determining Factors, Vs. Depreciation

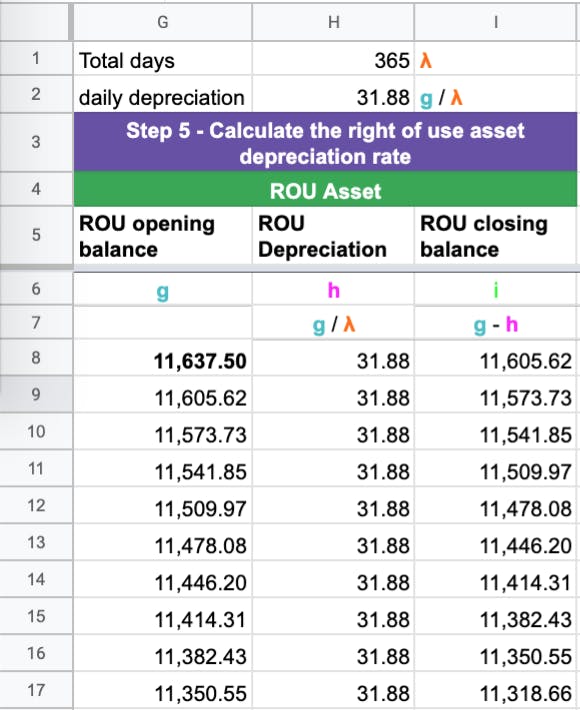

How to calculate a lease liability and right-of-use asset under IFRS 16

Property, Plant, and Equipment (PP&E): Meaning, Formula, and Examples - Stock Analysis

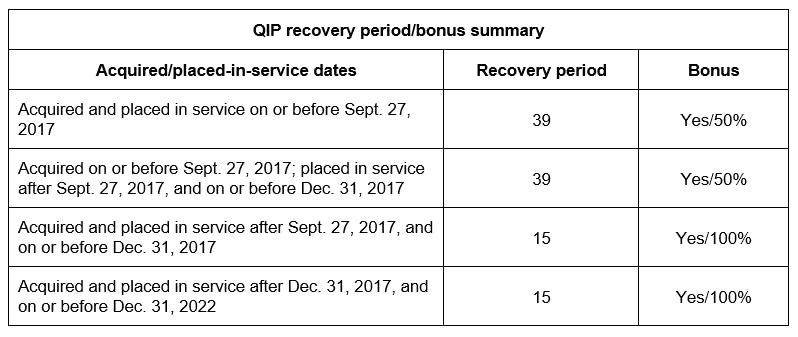

Bonus depreciation rules, recovery periods for real property and expanded section 179 expensing - Baker Tilly

Depreciation Expense, Definition, Types & Formula - Video & Lesson Transcript

:max_bytes(150000):strip_icc()/AssetDepreciationRangeADR_v2-838da260395a4be4ac851397f47e33ea.jpg)

How to Determine a Tangible Asset's Useful Life?

Depreciable Asset Lives - The CPA Journal

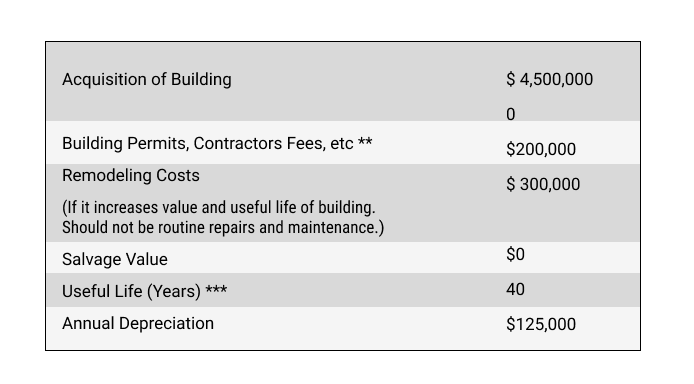

Calculate Depreciation Expense

Depreciation method used in France at the governmental level

de

por adulto (o preço varia de acordo com o tamanho do grupo)