Publication 970 (2022), Tax Benefits for Education

Descrição

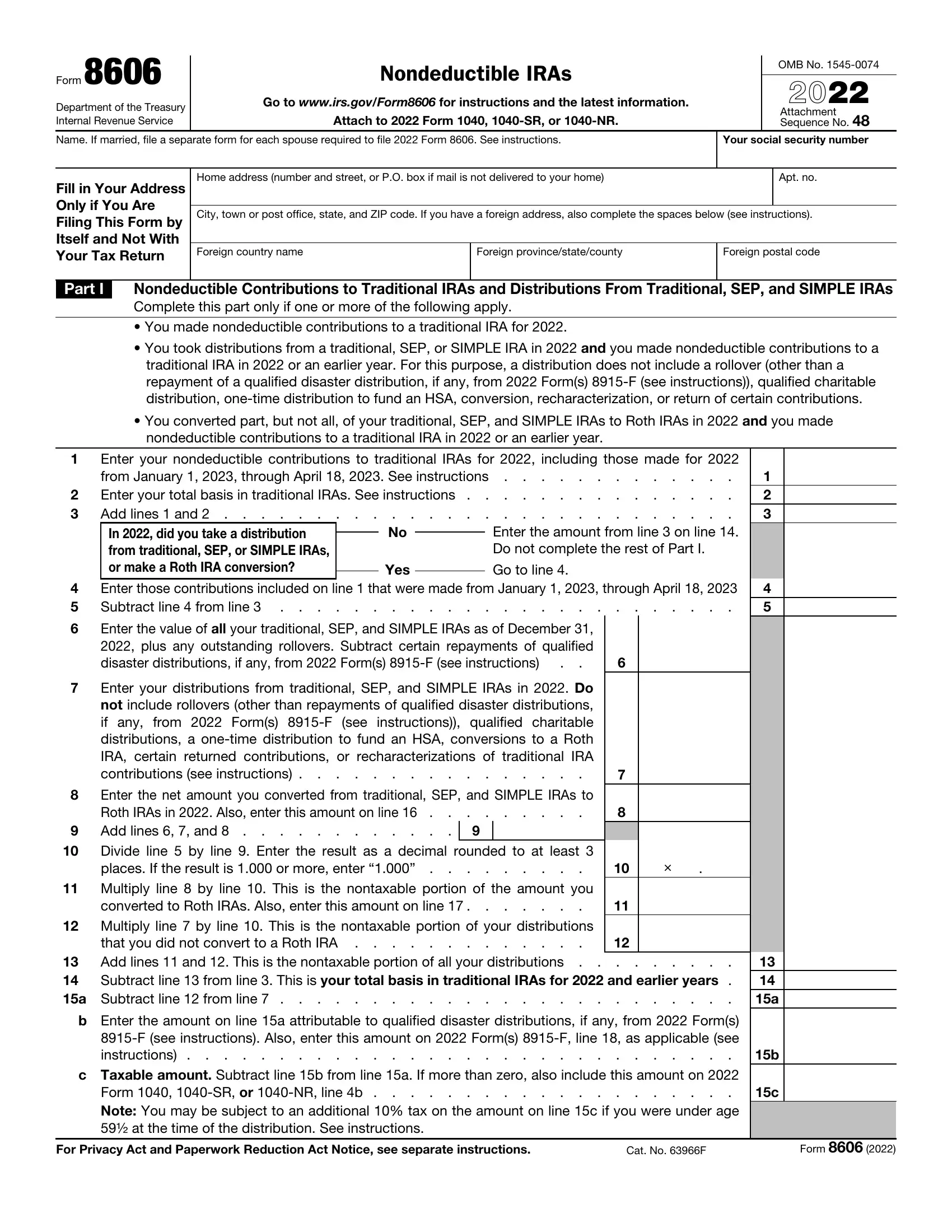

Publication 970 - Introductory Material Future Developments What's New Reminders

New 2022 IRS Income Tax Brackets And Phaseouts For Education Tax Breaks

TAS Tax Tip: Tax resources for individuals filing a federal income tax return for the first time - TAS

IRS 1098-T Tax Form for 2022

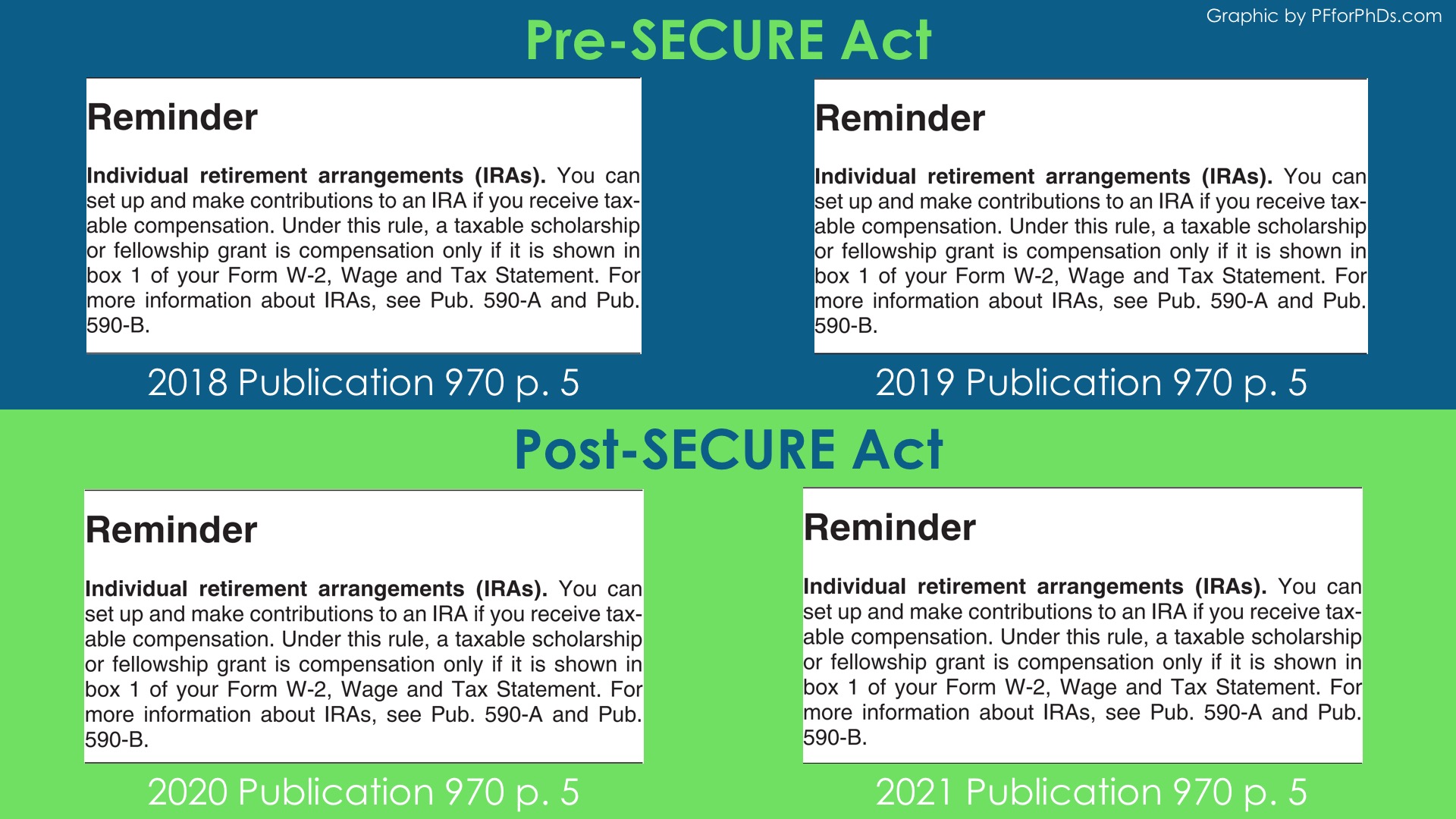

Is Fellowship Income Eligible to Be Contributed to an IRA? - Personal Finance for PhDs

Teacher Expense Income Tax Deduction Raised to $300 - CPA Practice Advisor

Educator expense tax deduction increases for 2022 returns

The 2 Education Tax Credits for Your Taxes

American Opportunity Tax Credit

About Publication 970, Tax Benefits for Education

:max_bytes(150000):strip_icc()/taxsmart-ways-help-your-kidsgrandkids-pay-college.aspv2-ca33db2b45af47d2bcd23ca1a70304df.jpg)

Tax-Smart Ways to Help Your Kids or Grandkids Pay for College

8863 Credit Limit Worksheet ≡ Fill Out Printable PDF Forms Online

Tax Credit – 1098-T, Student Financial Services

de

por adulto (o preço varia de acordo com o tamanho do grupo)