Bona Fide Residence test explained for US expats - 1040 Abroad

Descrição

How can US expat qualify for the Foreign Earned Income exclusion? Passing Bona Fide Residence Test and meeting its requirements explained in tax infographic.

10 U.S. EXPAT TAX FILING TIPS - Expat Tax Professionals

Bona Fide Residence test explained for US expats - 1040 Abroad

Tax Forms - Expatriate Taxes

Bona Fide Residence Test For U.S. Expats Explained

Expat Tax Guide - Expat Intelligence

How can American expats exclude their income from US tax liability?

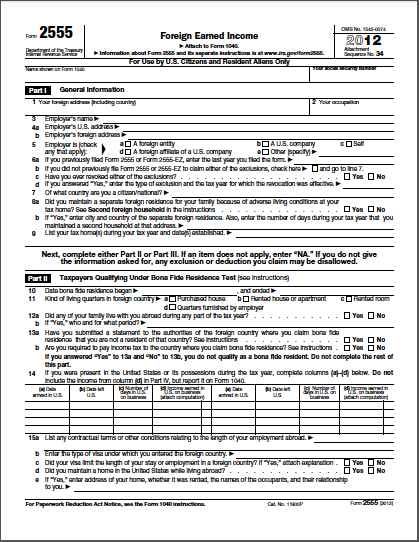

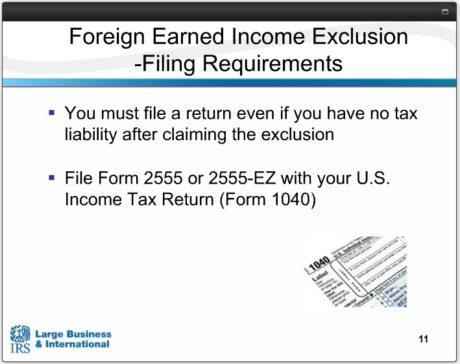

Form 2555 and FEIE (Guidelines)

Bona Fide Residence Test - Remote Financial Planner

How the Foreign Earned Exclusion Works for Expats (FEIE)

Foreign Earned Income Exclusion: Bona Fide Vs Physical Presence Test - Universal Tax Professionals

London expats return to the classroom for lessons on FBARs, foreign tax credits and PFICs: Part

Bona Fide Residence test for U.S. expats explained, by 1040 Abroad

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at11.58.37PM-68ccc0edb6ce4cb8acf163430cfa938b.png)

Form 4563: Exclusion of Income for Bona Fide Residents of American Samoa Definition

What is a Foreign Earned Income for U.S. expats? - 1040 Abroad

What U.S. Expats Should Know About The FEIE

de

por adulto (o preço varia de acordo com o tamanho do grupo)