Requesting FICA Tax Refunds For W2 Employees With Multiple Employers

Descrição

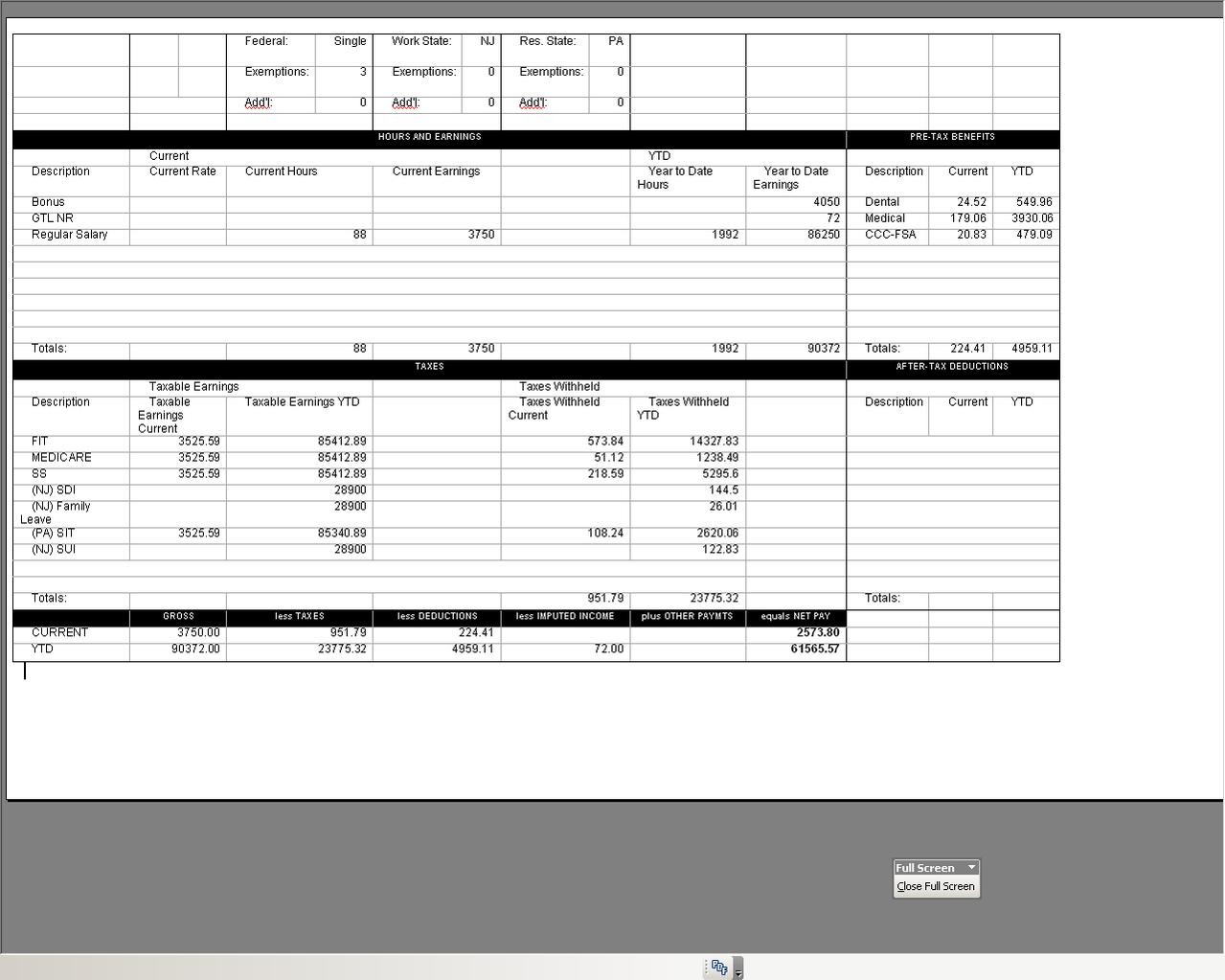

If you are a W2 employee who makes over $160,200 per year and you have multiple employers or you switched jobs during the year, or you have both a W2 job and a self-employment gig, your employer(s) may be withholding too much FICA tax from your wages and you may be due a refund of those FICA tax ove

:max_bytes(150000):strip_icc()/843-ClaimforRefundandRequestforAbatement-f50c59124198404abb88bc50a5f81fc4.png)

Form 843: Claim for Refund and Request for Abatement: How to File

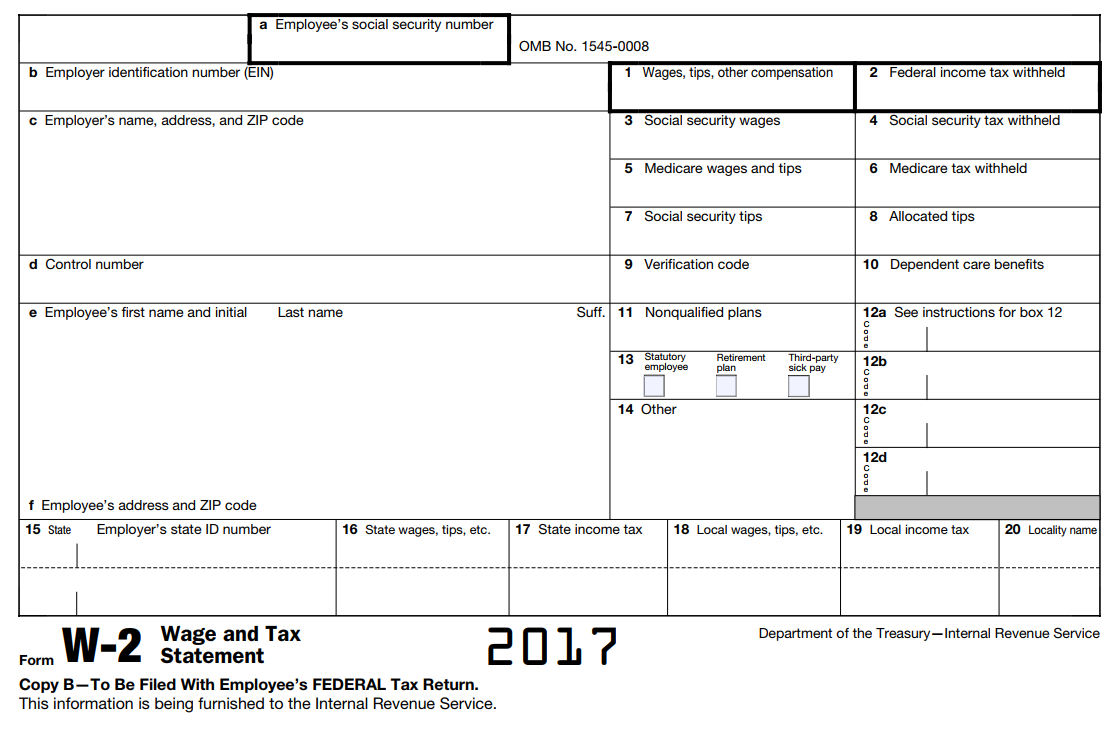

Understanding W-2 Boxes and Codes

What to Do When Employee Withholding Is Incorrect - CPA Practice

What is FED MED/EE Tax?

3.03 - Calculating Box Totals on Form W-2

Payroll tax - Wikipedia

1099, W-9, W-2, W-4: A guide to the tax forms and who fills them out

Filing a W-2 and 1099 Together: A Guide for Multi-Income Workers

No Form W-2, Wage and Tax Statement? Get Help From IRS

de

por adulto (o preço varia de acordo com o tamanho do grupo)