FICA Tax Rate: What is the percentage of this tax and how you can calculated?

Descrição

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hosp

FICA Tax Rate: What is the percentage of this tax and how you can calculated?

SSDI & Federal Income Tax ~ NOSSCR

Payroll Tax: What It Is, How to Calculate It

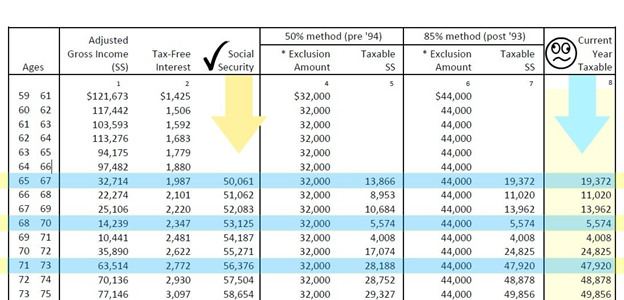

Calculating Taxable Social Security Benefits - Not as Easy as 0%, 50%, 85%

How to Calculate Withholding Tax and How Much Tax To Withheld

Federal & State Payroll Tax Rates for Employers

Payroll tax rates: Navigating the Complexities of Payroll Tax Rates - FasterCapital

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons

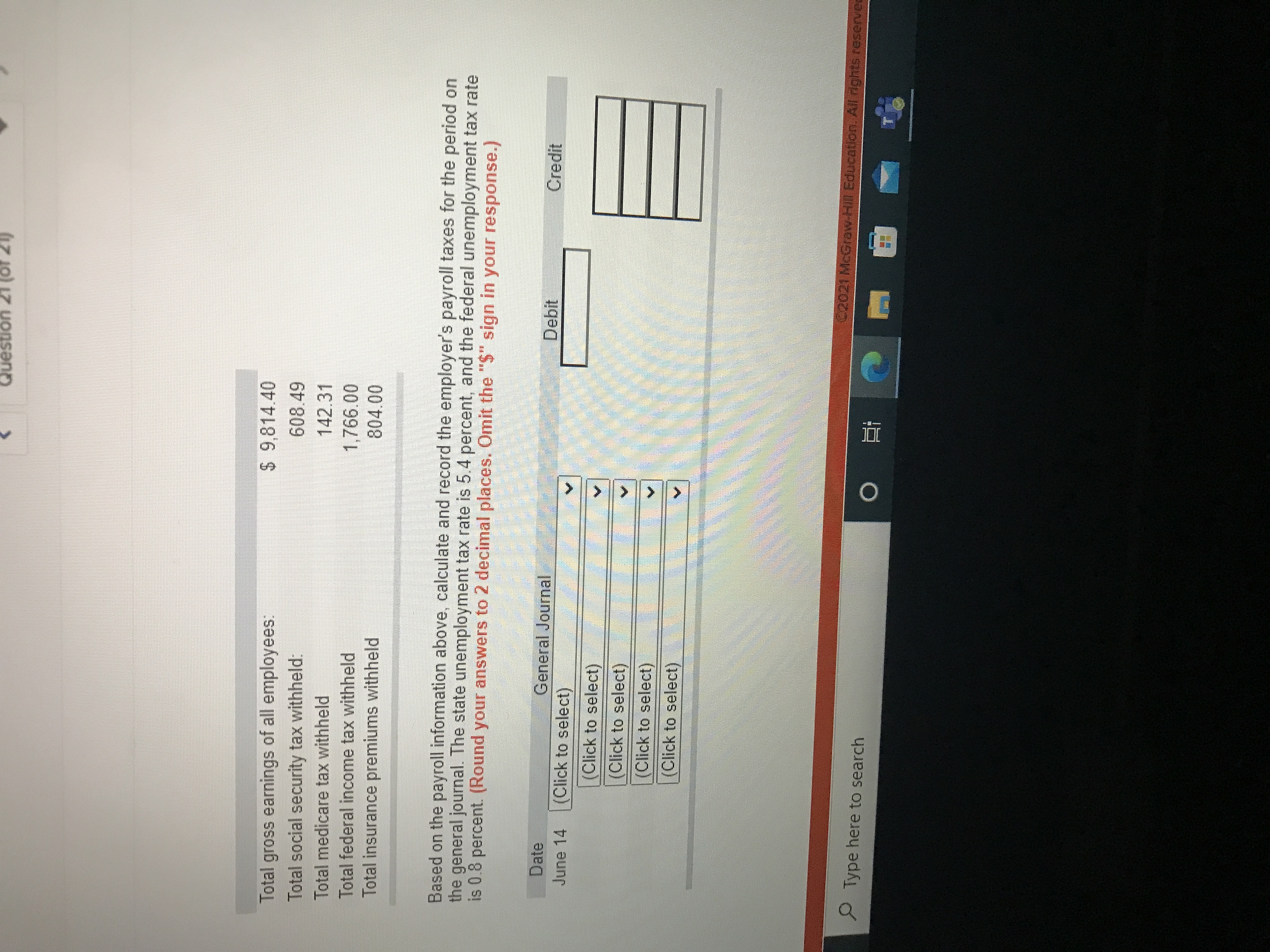

Assume a tax rate of 6.2% on $128,400 for Social Security and 1.45% for Medicare. No one will reach the

How to Calculate Social Security Wages From Pay Stub?

How to calculate payroll taxes 2021

Payroll tax - Wikipedia

Answered: LZ Uonsəno Total gross earnings of all…

de

por adulto (o preço varia de acordo com o tamanho do grupo)

.jpg)

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)