Overview of FICA Tax- Medicare & Social Security

Descrição

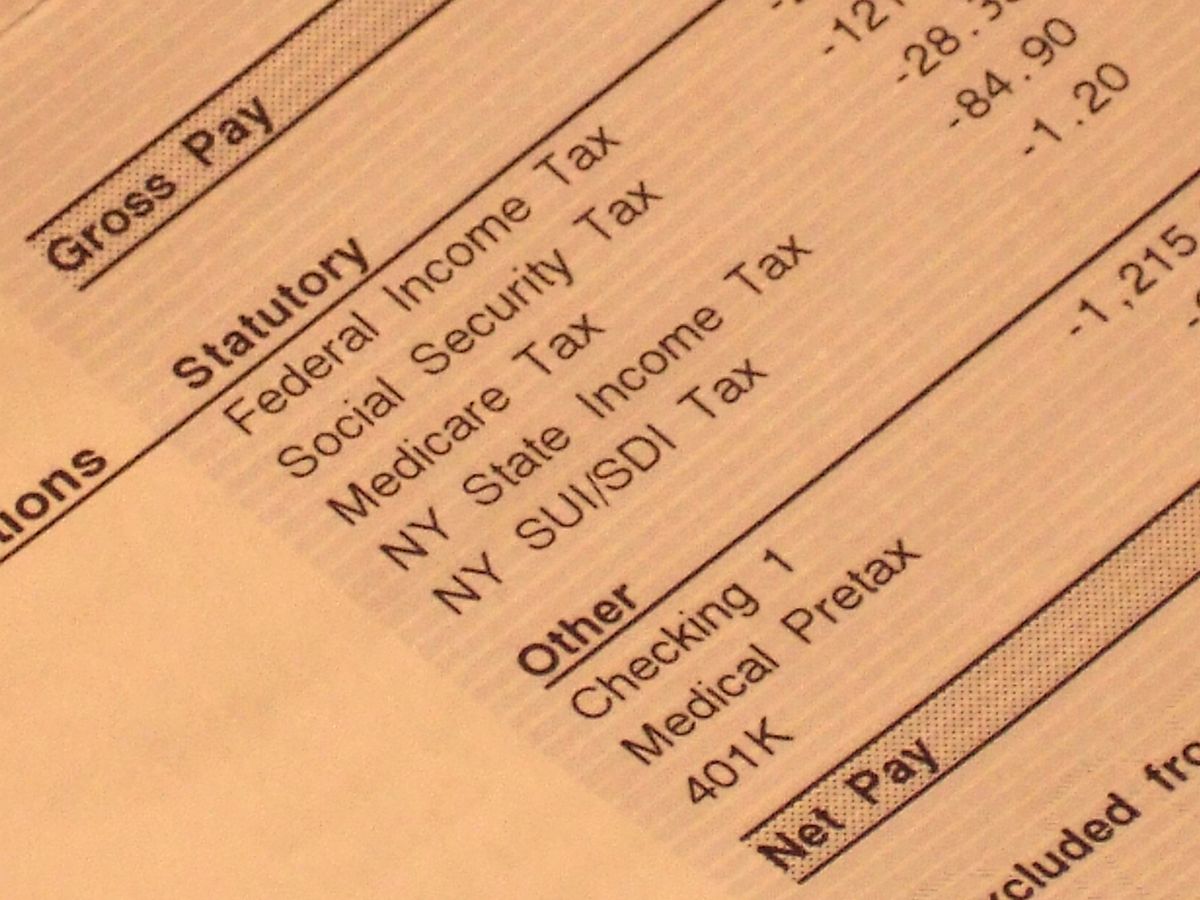

FICA represents the Federal Insurance Contributions Act, and it's a government tax that businesses and workers pay. FICA Taxes are the fundamental subsidizing focal point for Social Security benefits.

FICA and Withholding: Everything You Need to Know - TurboTax Tax

2024 Social Security Wage Base

What Is FICA on a Paycheck? FICA Tax Explained - Chime

What are the major federal payroll taxes, and how much money do

What is FICA tax?

FICA Tax Exemption for Nonresident Aliens Explained

What are FICA Taxes? 2022-2023 Rates and Instructions

How Avoiding FICA Taxes Lowers Social Security Benefits

What is FICA Tax? - Optima Tax Relief

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet

Overview of FICA Tax- Medicare & Social Security

What Are FICA Taxes And Why Do They Matter? - Quikaid

de

por adulto (o preço varia de acordo com o tamanho do grupo)