Learn About FICA, Social Security, and Medicare Taxes

Descrição

Learn about what FICA taxes are, withholding Social Security and Medicare taxes from employee pay, and how to calculate, report, and pay FICA taxes to the IRS.

FICA Tax in 2022-2023: What Small Businesses Need to Know

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

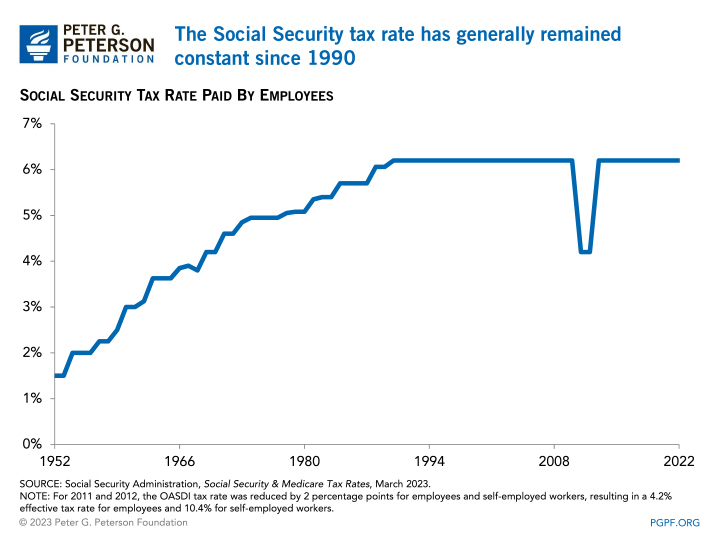

What Is Social Security Tax? Definition, Exemptions, and Example

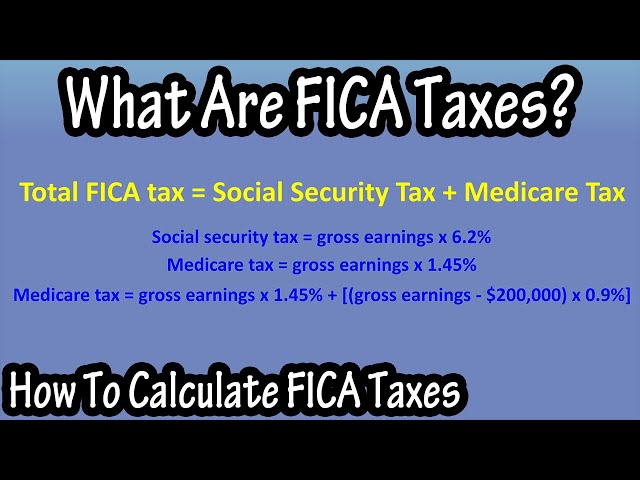

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes

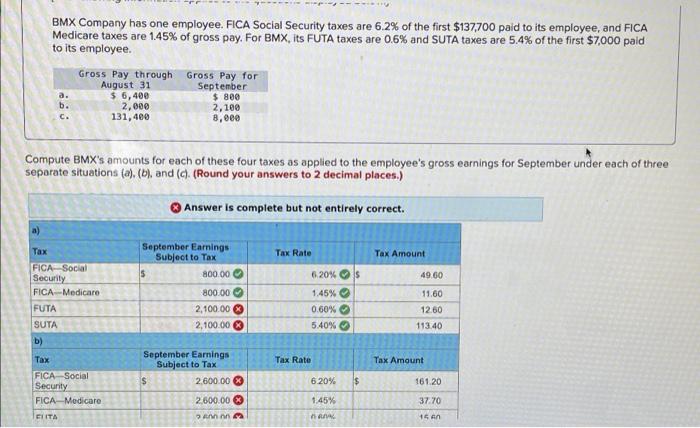

Solved BMX Company has one employee, FICA Social Security

Excel & Business Math 34: MEDIAN Function for FICA Social Security & Medicare Payroll Deductions

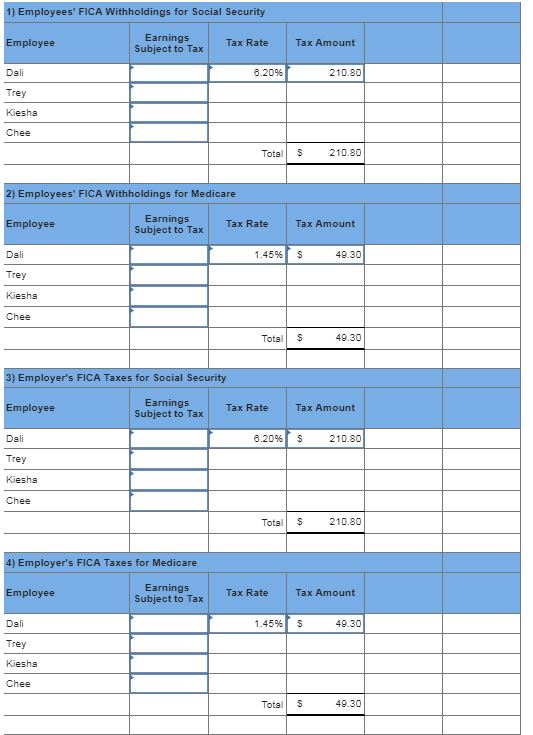

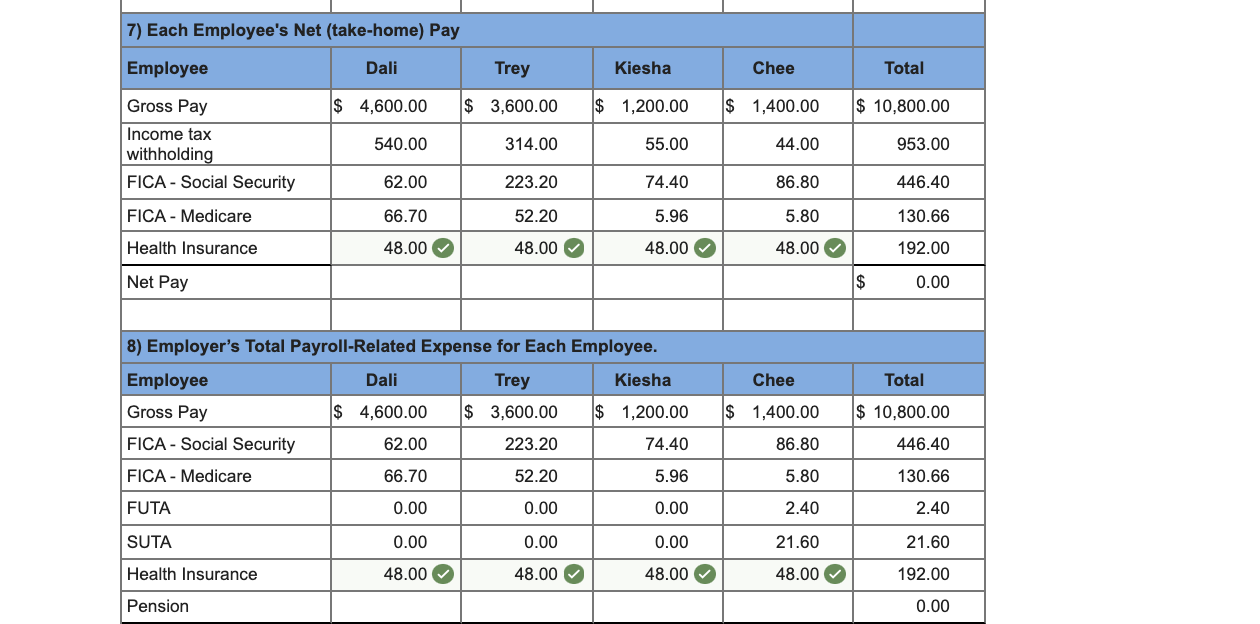

Solved Paloma Co. has four employees. FICA Social Security

What is FICA Tax? - The TurboTax Blog

What Are Medicare Taxes? - SmartAsset

Beyond Numbers: FICA: s Impact on Your W 2 Form - FasterCapital

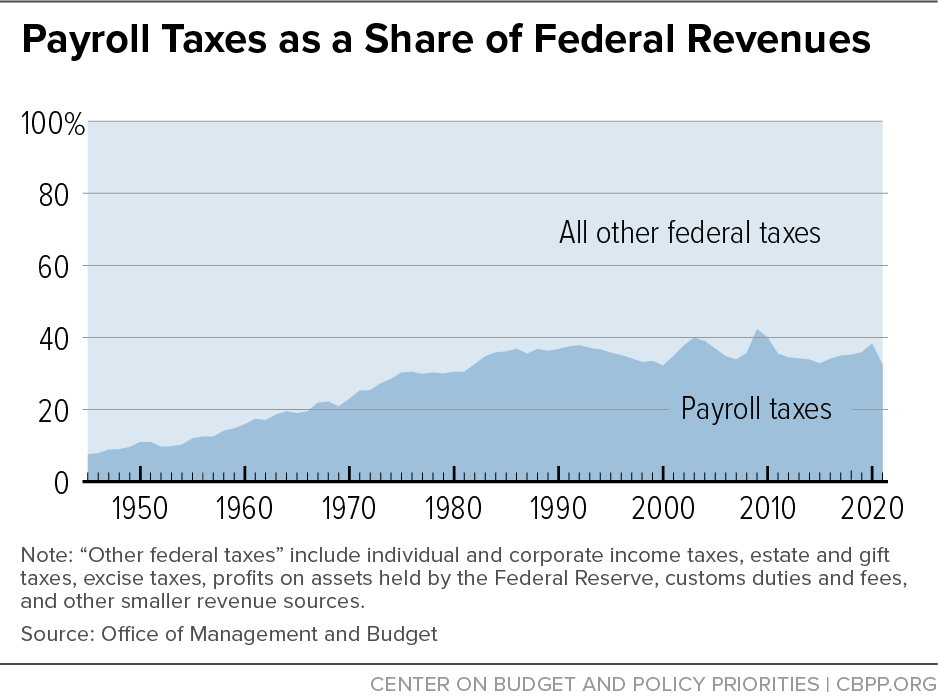

Payroll Taxes: What Are They and What Do They Fund?

Policy Basics: Federal Payroll Taxes Center on Budget and Policy Priorities

Solved Paloma Company has four employees. FICA Social

Understanding FICA, Medicare, and Social Security Tax

What is FED MED/EE Tax?

de

por adulto (o preço varia de acordo com o tamanho do grupo)