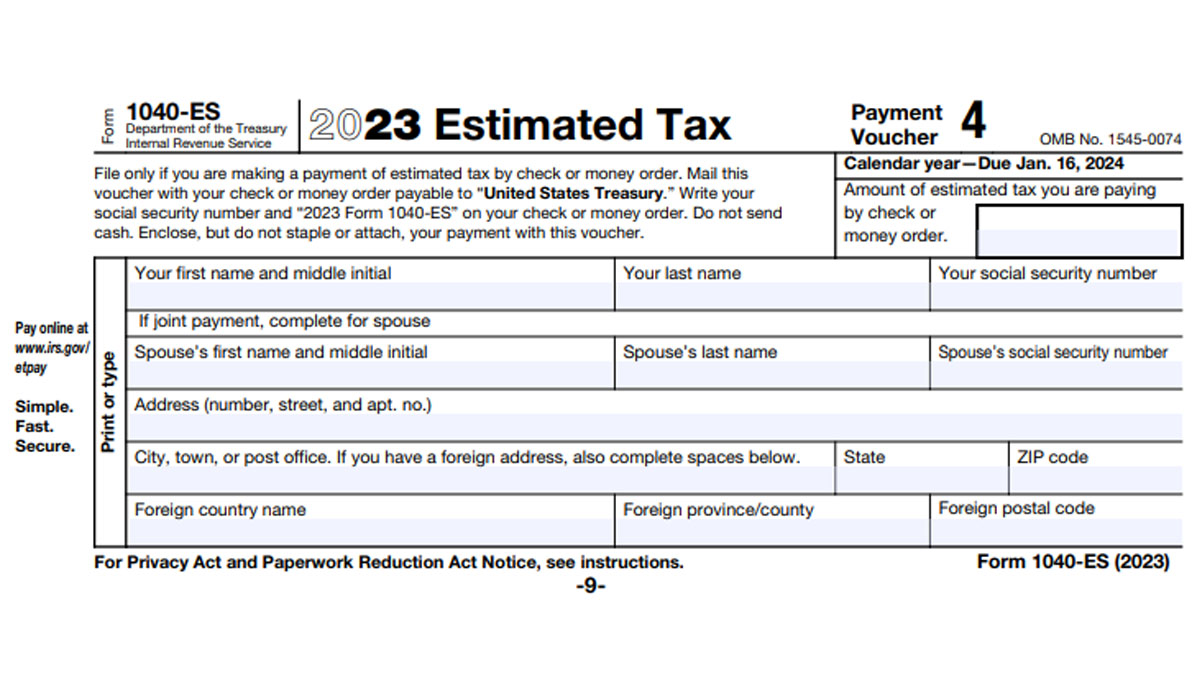

Tax Underpayment Penalty: What It Is, Examples, and How to Avoid One

Descrição

An underpayment penalty is an IRS fee for failing to pay enough of your total tax liability during the year. Here’s how to determine if you owe an underpayment penalty.

How Retirees Can Avoid Paying Quarterly Taxes Without Getting Penalized – Financial Success MD

What Happens If You Miss a Quarterly Estimated Tax Payment?

What Happens If You Don't File Your Taxes?

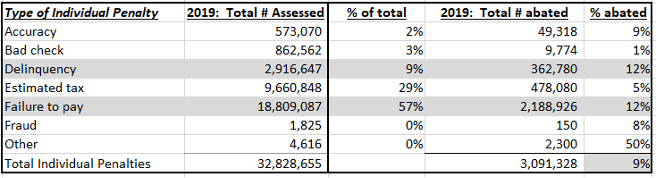

Do's and Don'ts When Requesting IRS Penalty Abatement - Jackson Hewitt

The Dreaded Underpayment Penalty: How to Avoid It - KB Financial

Penalty for Underpayment of Estimated Tax

What Happens If You Miss a Quarterly Estimated Tax Payment?

:max_bytes(150000):strip_icc()/irs-pub-433.asp-Final-060f721b11b441b0a4b85b4ec6c6186a.jpg)

IRS Notice 433: Interest and Penalty Information

IRS Penalty and Interest Calculator, 20/20 Tax Resolution

Avoiding Underpayment Penalty: The Consequences of Late Payment - FasterCapital

Use These 3 Tips to Avoid Estimated Tax Penalties - SH Block Tax Services

de

por adulto (o preço varia de acordo com o tamanho do grupo)

/origin-imgresizer.eurosport.com/2023/10/24/3811232-77476568-2560-1440.jpg)