High-Low Method Definition

Descrição

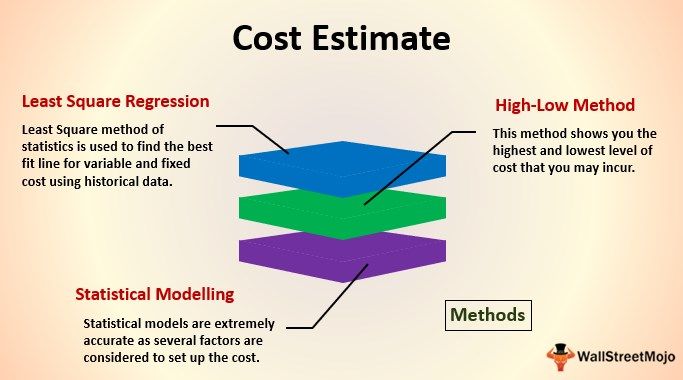

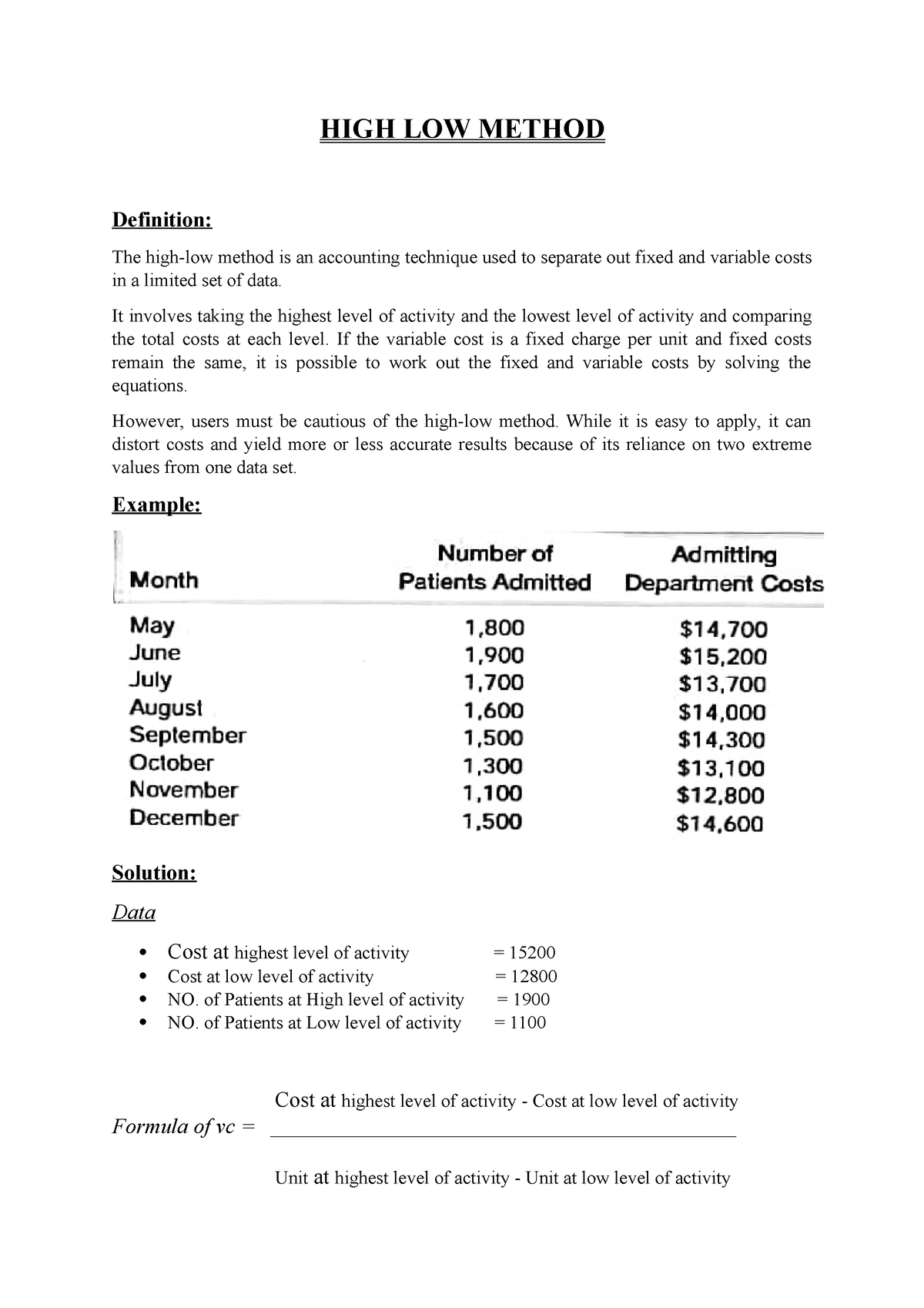

In cost accounting, the high-low method is a way of attempting to separate out fixed and variable costs given a limited amount of data.

Cost and Management Accounting Unit 1 Notes, PDF, Cost Of Goods Sold

High-Low Method Accounting, Definition, Formula & Examples - Video & Lesson Transcript

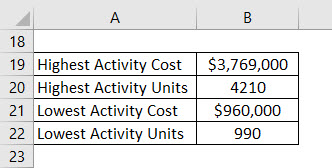

High Low Method Calculate Variable Cost Per Unit and Fixed Cost

Least Squares Method vs High Low Method Comparative Illustration

Dheeraj on X: Cost Estimate (Definition, Types) Top 3 Methods of Cost Estimation #CostEstimate / X

The High Low Method Explained with Examples

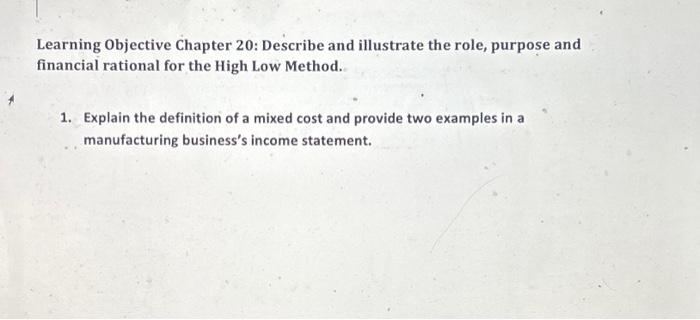

Solved Learning Objective Chapter 20: Describe and

:max_bytes(150000):strip_icc()/high-low-method-4195104-3x2-01-final-1-7c0d3b187b2f48f38a577ea1ada0c9ca.png)

Financial Analysis

Solved Describe and illustrate the role, purpose and

3-1 Cost Analysis Prepared by Douglas Cloud Pepperdine University Prepared by Douglas Cloud Pepperdine University ppt download

HIGH LOW METHOD OF SEPARATING MIXED COSTS

HIGH LOW Method - HIGH LOW METHOD Definition: The high-low method is an accounting technique used to - Studocu

High-Low Method Formula - What Is It, Examples, Calculation

High-Context Culture: Examples, Definition & Countries (2023)

High-Low Method in Accounting - FundsNet

de

por adulto (o preço varia de acordo com o tamanho do grupo)