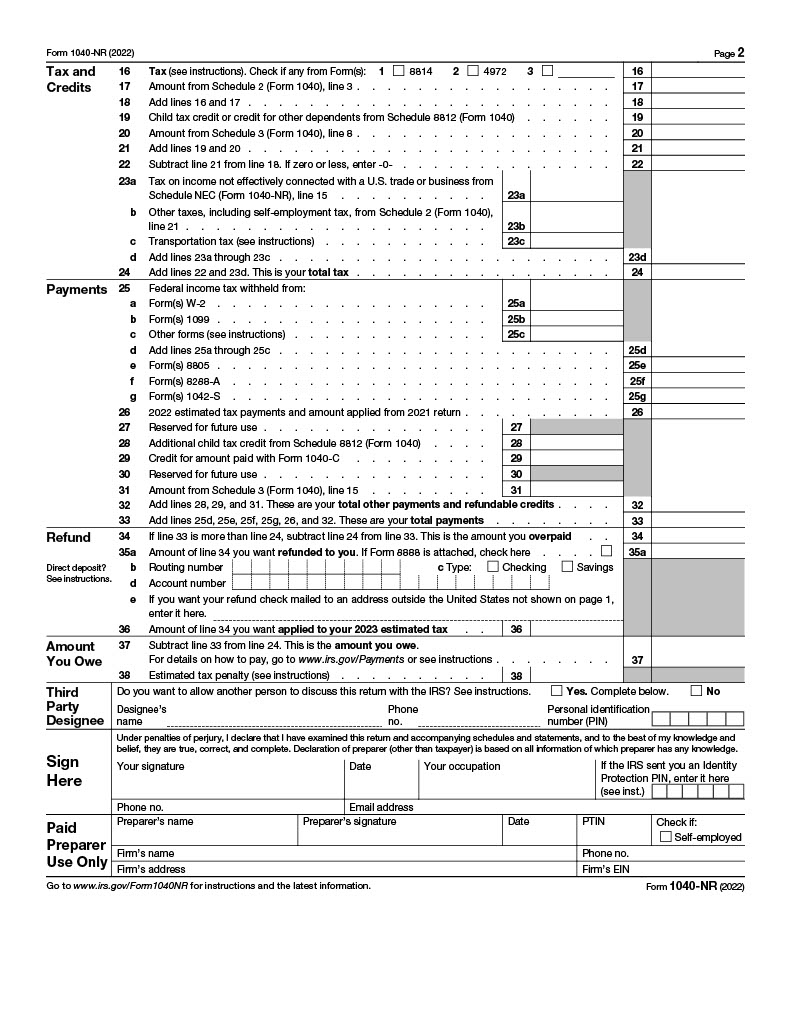

Students on an F1 Visa Don't Have to Pay FICA Taxes —

Descrição

In general, non-US citizens employed in the U.S. are required to pay FICA taxes. However, those with single intent, or non-immigrant status (or F1 visa holders) are exempt from FICA taxes.

How Can F1 Students Earn Passive Income? —

J-1 Visa Taxes Paying Social Security as a Nonimmigrant

F-1 Visa: How Parents Can Stay with Minor International Students in the U.S.

How do Undocumented Immigrants Pay Federal Taxes? An Explainer

How Can I Work And Earn Income While On An F1 Visa? —

How Much Income Tax Will I Pay While Working On An H1B In The US? —

International Students - CT State

Sample Pay Check and FICA Taxes Savings for CPT, OPT Studetns

US Tax Return & Filing Guide for International F1 Students [2021]

The Complete J1 Student Guide to Tax in the US

US Taxes for International Students - International Services

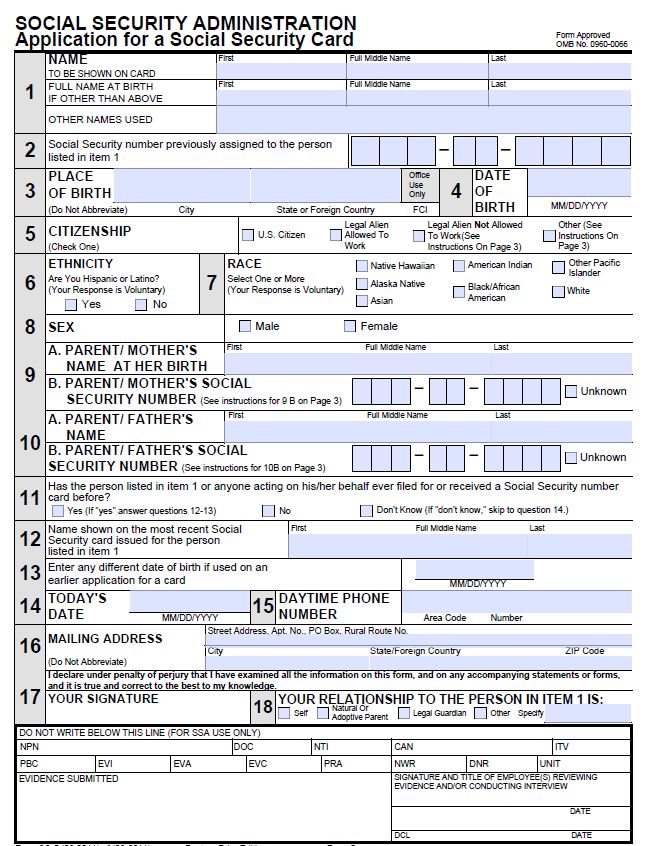

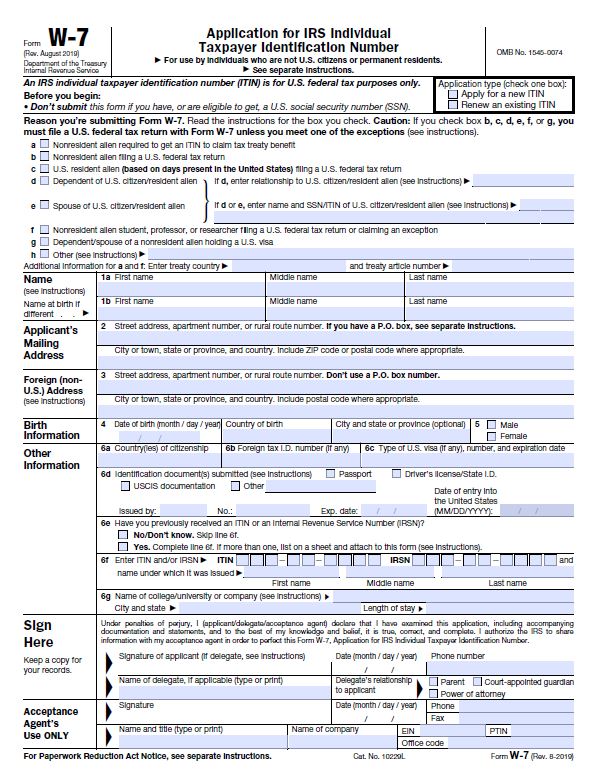

5 US Tax Documents Every International Student Should Know

5 US Tax Documents Every International Student Should Know

de

por adulto (o preço varia de acordo com o tamanho do grupo)