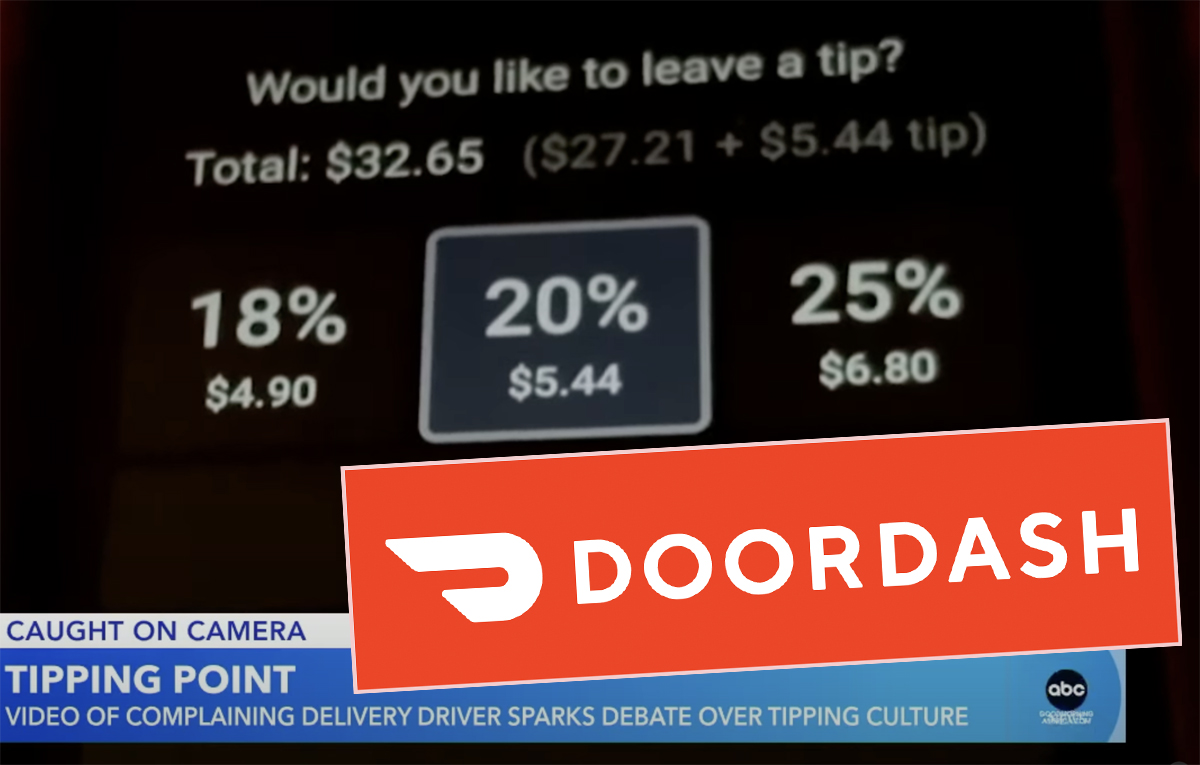

DoorDash Tax Deductions, Maximize Take Home Income

Descrição

This article is the ultimate guide for DoorDash tax deductions. Click to read and learn what DoorDashers can write off.

Nobody Wins With DoorDash. Examining the terrible economics of

Section 280a Deduction: Renting Your Personal Home to Your

Top 6 Tax Deductions for Food Delivery Drivers

Can You Get a Tax Refund with Doordash? How the Income Tax Process

How Much Should I Save for Doordash Taxes?

DoorDash Driver Archives < Falcon Expenses Blog

Deliver with DoorDash? Save $20 on Your Taxes with TurboTax Self

How to File DoorDash Taxes DoorDash Drivers Write-offs

Doordash Is Considered Self-Employment. Here's How to Do Taxes

Places With the Highest and Lowest Income Tax Rate and Take Home

Taxes Doordash Uber Eats Grubhub Instacart Contractors - EntreCourier

Doordash Taxes Made Easy, Ultimate Dasher's Guide, Ageras

How to fill out a Schedule C tax form for 2023

de

por adulto (o preço varia de acordo com o tamanho do grupo)