Breaking Down The Impact Of UK's Value Added Tax On Sellers

Descrição

recently announced that sellers on its U.K. platform will be required to pay a 20% value-added tax on fees paid to the company beginning August this year. The new VAT is applicable to sellers that have annual turnover (sum total of all goods sold through the website) in excess of £85,000.

What is VAT and how does it work?

-Slider-image-2-700x505px.jpg)

The Impact of COVID-19 on Major Non-Food UK Retailers

Value-added tax - Wikipedia

The effect of tax cuts on economic growth and revenue - Economics Help

Tax statistics: an overview - House of Commons Library

VAT: a brief history of tax, Tax

Value-Added Tax (VAT): Definition, Who Pays - NerdWallet

PDF) Value Added Tax Reforms

Brexit VAT changes: The impact on UK SMEs — Just Entrepreneurs

Breaking Down The Impact Of UK's Value Added Tax On Sellers

The Value Added Tax in the United Kingdom

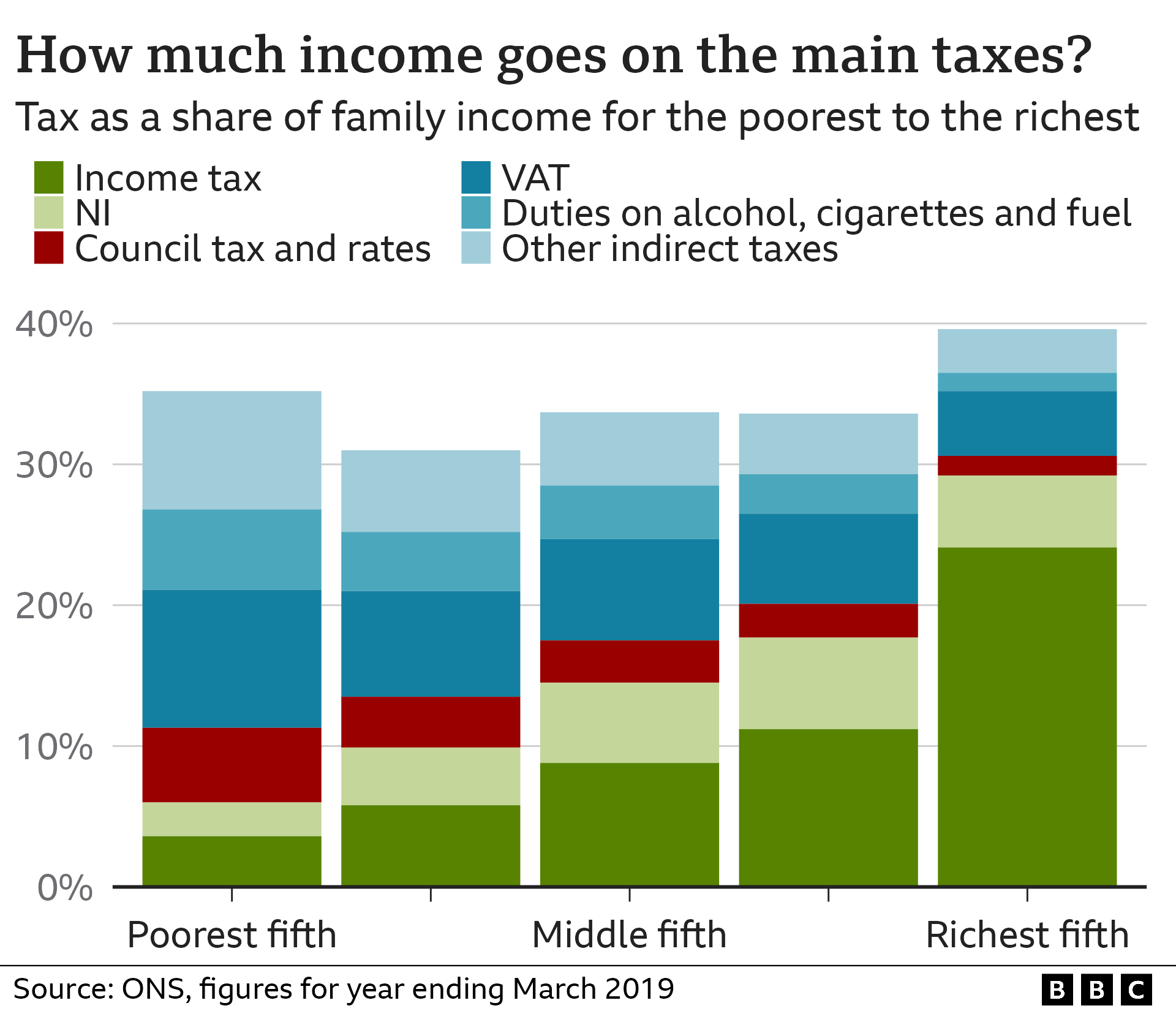

Effects of taxes and benefits on UK household income - Office for National Statistics

Estimating the repercussions from China's export value‐added tax rebate policy* - Gourdon - 2022 - The Scandinavian Journal of Economics - Wiley Online Library

de

por adulto (o preço varia de acordo com o tamanho do grupo)