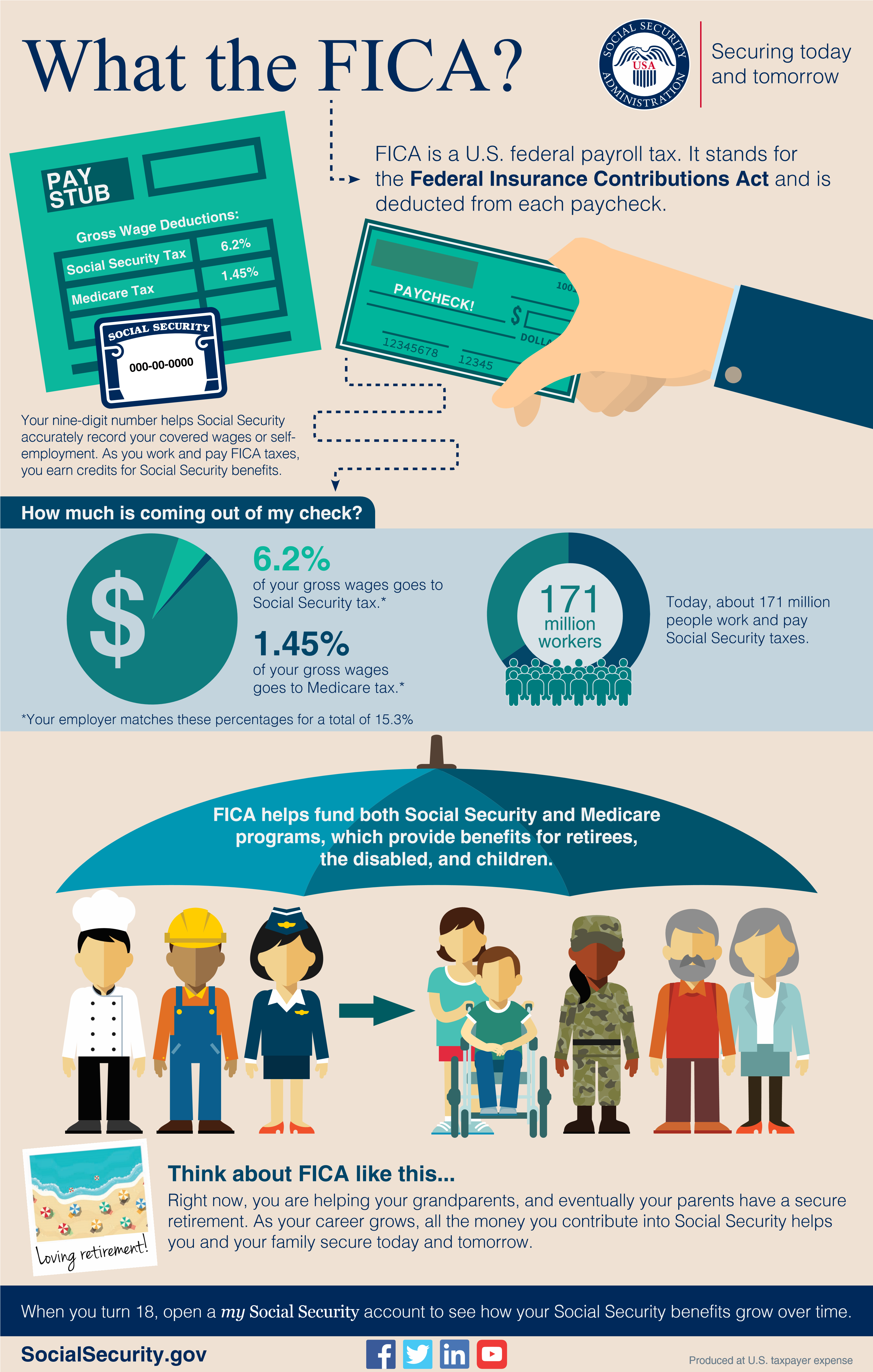

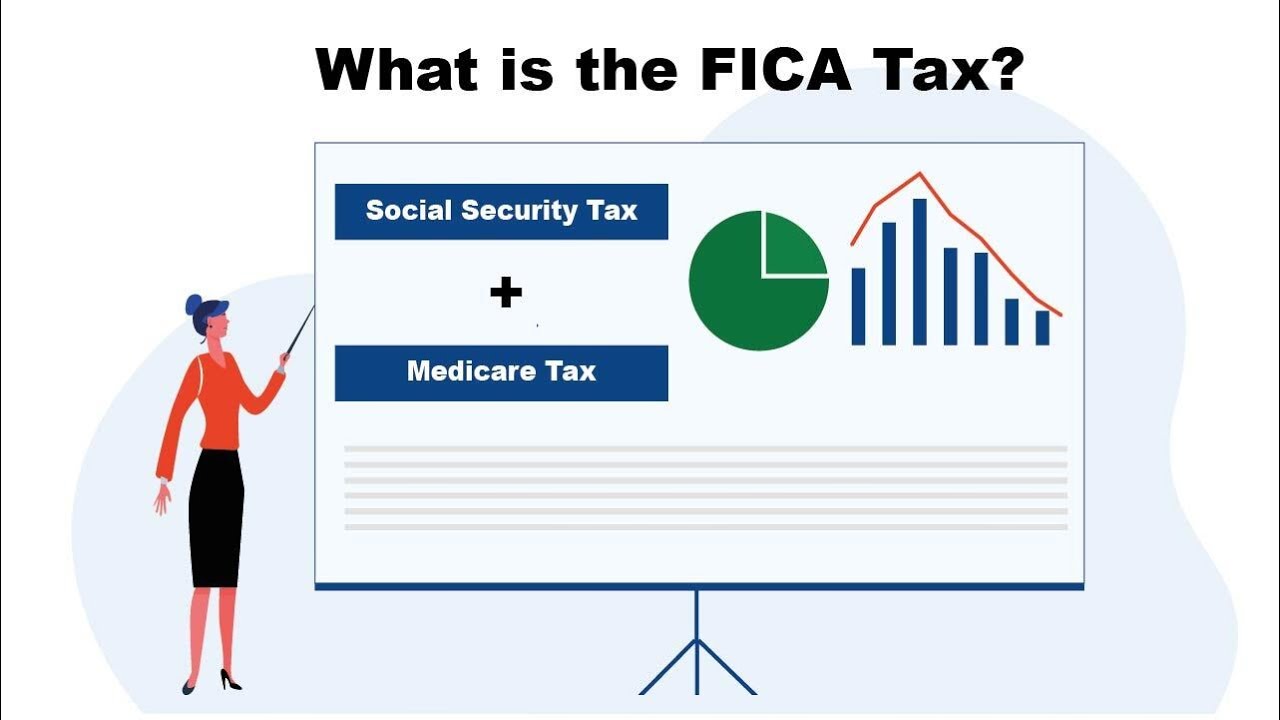

How An S Corporation Reduces FICA Self-Employment Taxes

Descrição

How an S corporation can reduce FICA taxes, the criteria for qualifying for FICA-exempt S corporation dividends, and why an S corp may not always be best.

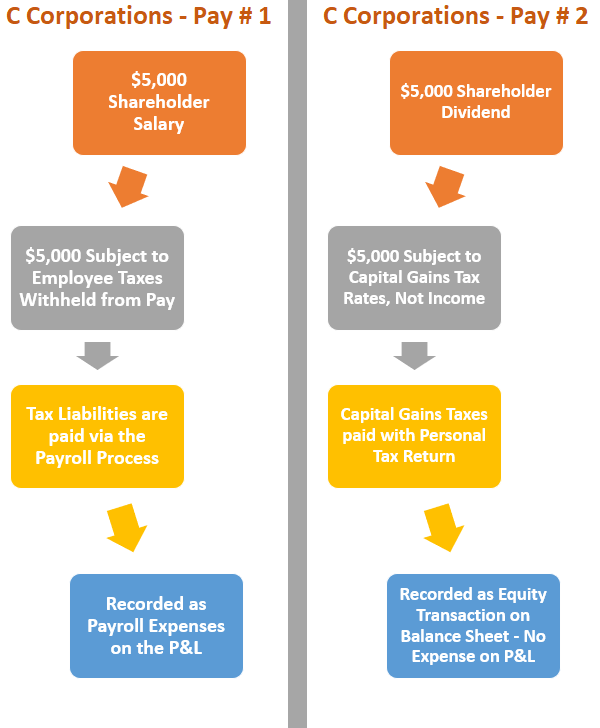

Understand How Small Business Owners Pay Themselves & Track Self-Employment Tax Liabilities - Lend A Hand Accounting

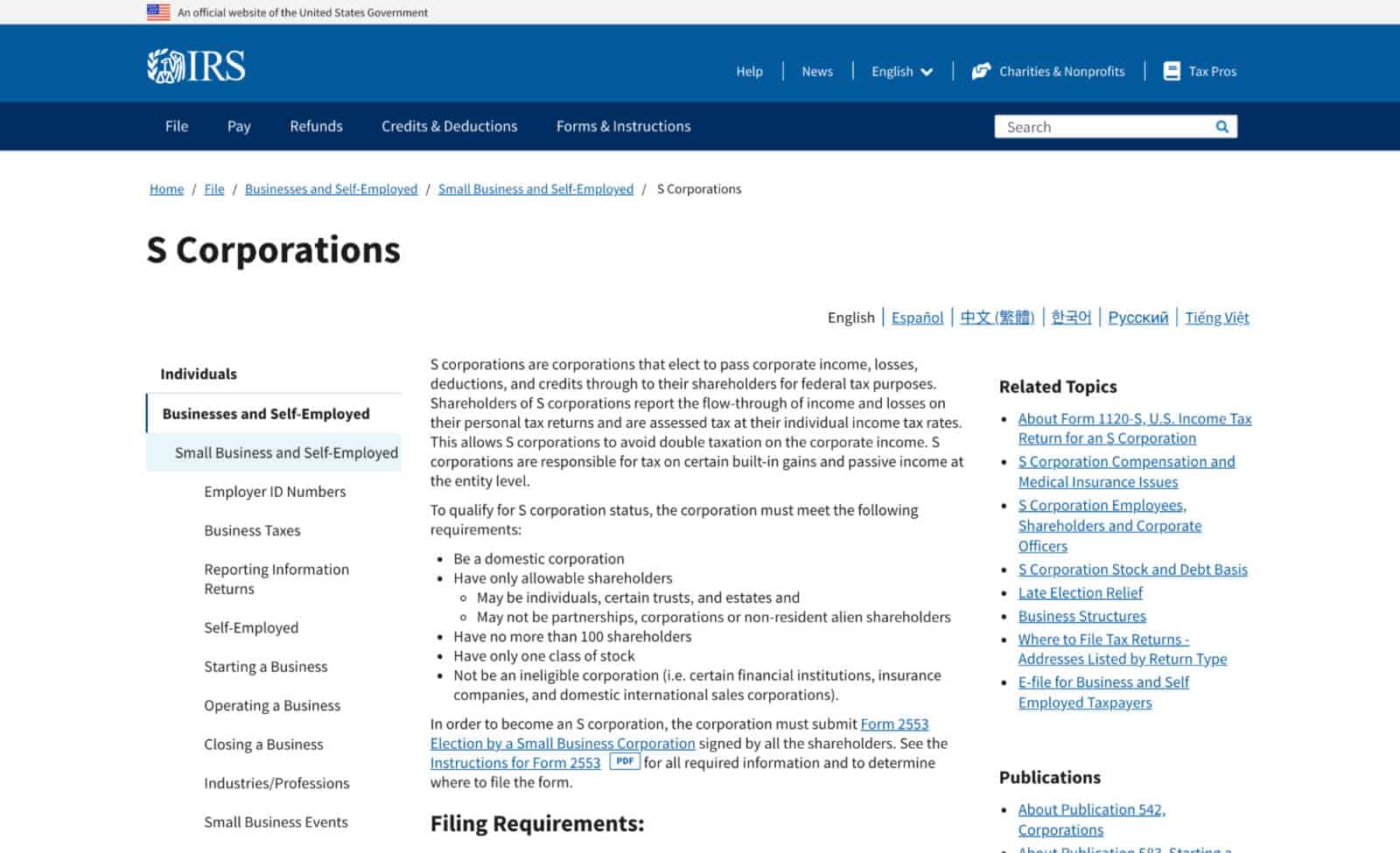

Using an S corporation to avoid self-employment tax

How An S Corporation Reduces FICA Self-Employment Taxes

Converting LLC to S-Corp (Step-by-Step)

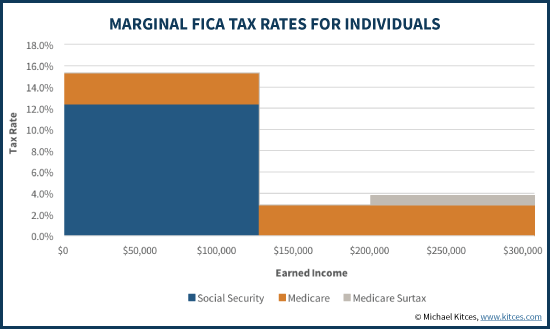

How an S Corporation Can Reduce Self-Employment Taxes

Benefits of the S-Corporation Election

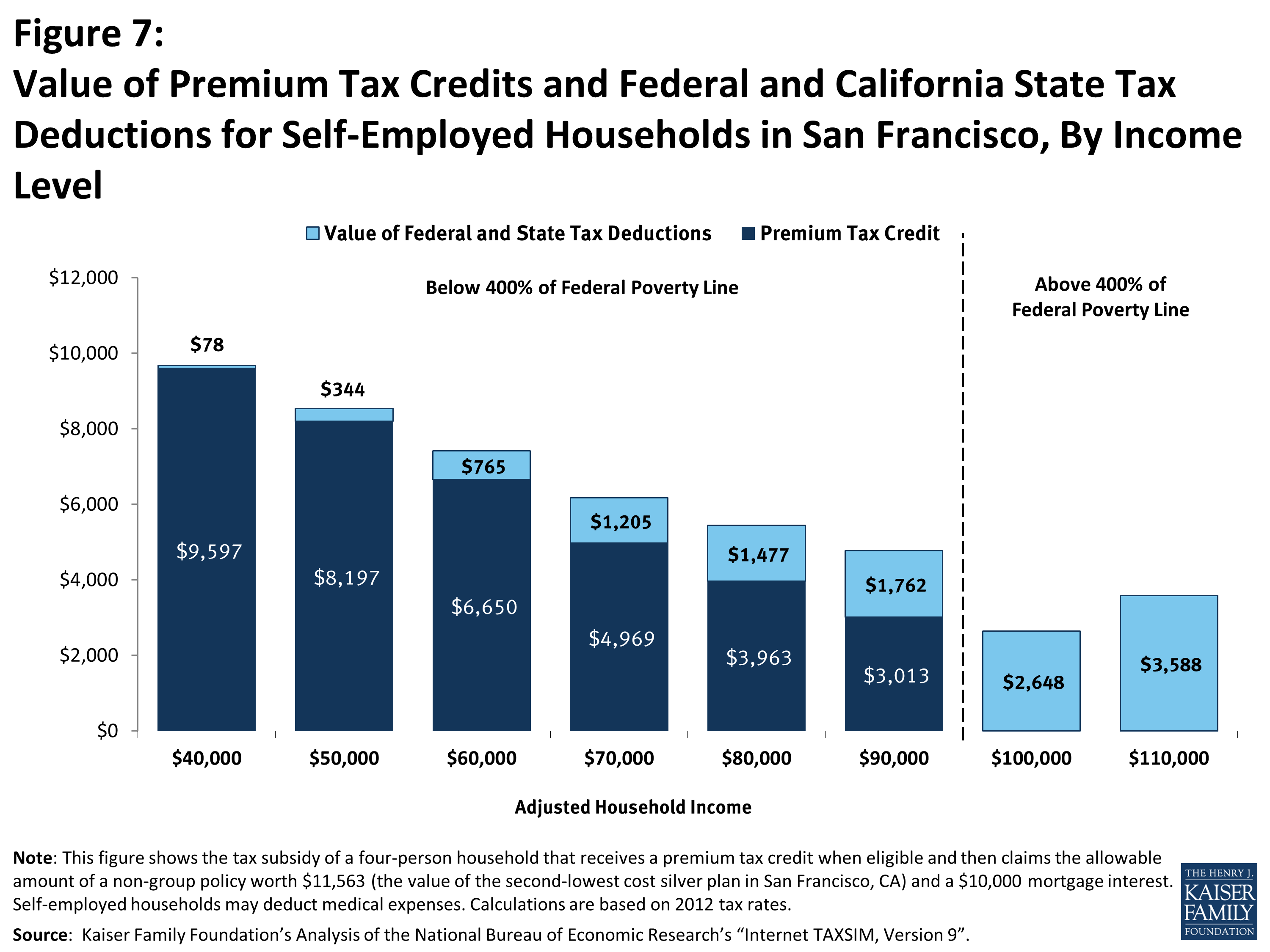

Tax Subsidies for Private Health Insurance - III. Special Tax Deduction for Health Insurance Premiums for the Self-Employed - 7779-02

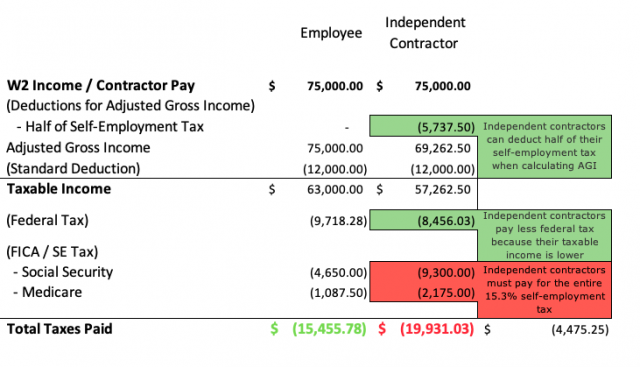

How Much in Taxes Do You Really Pay on 1099 Income? - Taxhub

How to Pay Yourself as an LLC

Why You Should Form an S Corporation (and When)

CORPORATION: Calculating My Solo 401k contributions for a Corporation - My Solo 401k Financial

What Is the Self-Employment Tax? Which Deductions Can You Take? - TheStreet

Taxation of an S-Corporation: The Why (Benefits) & How (Rules)

Do LLCs Pay Self Employment Tax?

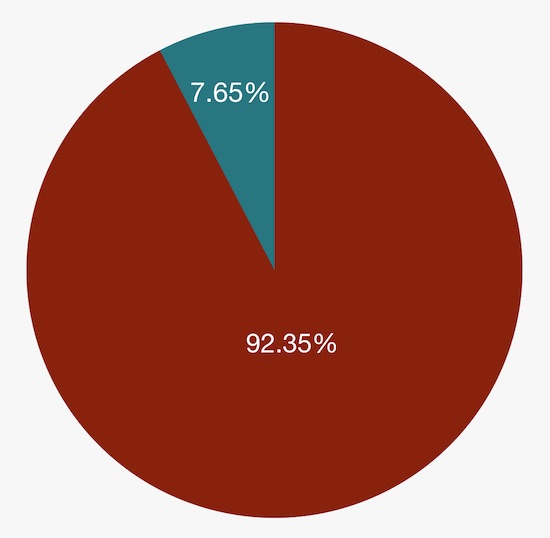

How to calculate self employment taxes

de

por adulto (o preço varia de acordo com o tamanho do grupo)