2021 FICA Tax Rates

Descrição

Social Security and Medicare income limits and tax rates FICA tax is a combination of a Social Security tax and a Medicare tax. The Social Security tax is assessed on wages up to $142,800 ($137,700 in 2020); the Medicare tax is assessed on all wages.

FICA Tax in 2022-2023: What Small Businesses Need to Know

How Do Marginal Income Tax Rates Work — and What if We Increased Them?

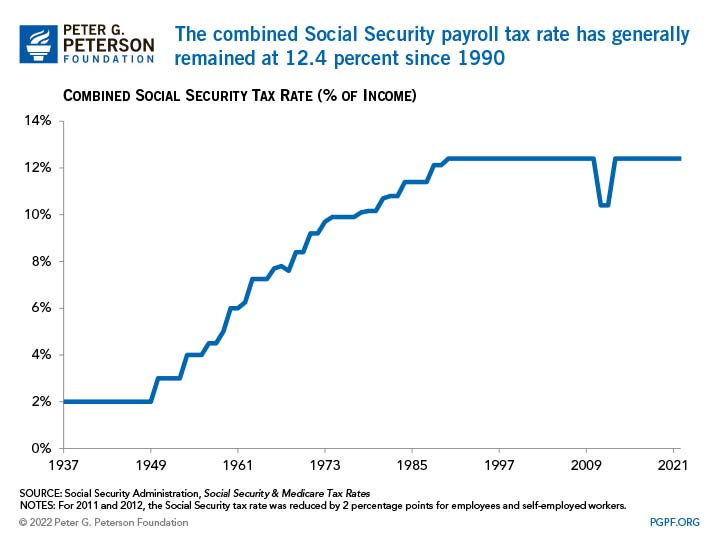

What are the major federal payroll taxes, and how much money do they raise?

2021 FICA Tax Rates

Social Security Reform: Options to Raise Revenues

FICA Tax: What It is and How to Calculate It

Federal Insurance Contributions Act - Wikipedia

Uncapping the Social Security Tax – People's Policy Project

What are the major federal payroll taxes, and how much money do they raise?

FICA tax rate 2022: How can you adjust you Social Security and Medicare taxes?

Understanding Medicare Tax

What Is Medicare Tax? Definitions, Rates and Calculations - ValuePenguin

de

por adulto (o preço varia de acordo com o tamanho do grupo)